What is causing the mortgage ‘mess’ to continue, in this case the controversy over ownership of mortgages that is embroiling Wall St. and Washington? Much of it is exaggerated by the media and attorneys for the plaintiffs suing various banks to take back those mortgages packaged and sold as mortgage backed securities. So it is not easy to understand the underlying facts, especially when real estate values have yet to stabilize.

The beginning of the mortgage origination process is fairly straightforward. When a bank, mortgage bank, or other entity originates a mortgage, it is either held by that lender in its “portfolio”, or sold to someone else. Many commercial banks still hold onto their shorter term loans—such as for businesses or construction projects. These are usually due within 5, and so don’t tie up a bank’s capital reserves for a longer period.

But most mortgages are permanent, meaning not due for 15-30 years. These are usually sold onto the secondary market—Wall Street firms who bundle them into mortgage pools that are sold to investors as mortgage backed securities (MBS). Some such securities for the VA/FHA, Fannie Mae, and Freddie Mac (the GSEs), are considered AAA rated, because either guaranteed or insured by the Federal Government. So someone holding a ‘Ginnie Mae’ Certificate knows it has an ownership share in a pool of AAA rated FHA/VA loans on which it receives a percentage yield.

The main ownership problem is that banks in particular may hold on to servicing the loan, even though it has been sold to investors. This means that said bank still collects the payments and passes them on for a fee of usually 3/8 to ½ percent of the loan amount. So if the ownership papers weren’t properly documented to the MBS investors, either servicers or investors may not have clear title to sell or auction the underlying property held as security if the property is foreclosed on.

Another ‘mess’ is if there was fraud involved—i.e., the loan originators didn’t follow their own underwriting guidelines when funding the mortgages. It is hard to believe that is the case, as lenders know they must buy back a loan if fraud—i.e., misrepresentation—is involved. But given the huge number of foreclosures—more than 2 million this year—so-called foreclosure mills in those 22 states who have judicial foreclosures may have taken shortcuts in not verifying all the documentation, or even faking lost documents.

Meanwhile, the delinquencies have declined substantially in 2010, and consumers incomes are improving--indicators that say real estate values may be stabilizing. And that is the bottom line in improving the foreclosure rate. Lenders tend to panic when housing values are falling, and so are quicker to foreclose in order to recoup as much as possible of loan principal.

Calculated Risk cites a report by LPS Applied Analytics that foreclosures leveled off at 3.92 percent, from a 1 percent historical rate and delinquencies at 9.29 percent in October, up from its historical 4 percent rate. So there is a long way to return to normal. Delinquencies began to take off at the beginning of 2007 (i.e., 3+ years ago), so it should take another 3 years to return to historical levels.

Home prices are coming under weakness again due to distressed sales adding to housing supply and tighter credit standards cutting demand, but that may be mainly to seasonal factors. Fewer homes are put on the market and sold during the winter months. The Federal Housing Finance Authority purchase only house price index for homes with conforming loans slipped 0.7 percent in September after no change the month before.

On a year-on-year basis, the FHFA HPI is down 3.4 percent, compared to down 2.8 percent in August. This index is based on resale prices for homes financed or bundled by federal housing agencies (i.e., the GSEs).

The price weakness is reflected in lower new and existing-home sales in October, down 2.2 and 14 percent, respectively. The National Association of Realtors also said the sales drop was mostly due to seasonal factors and tightened lending standards.

“A review of recently originated loans suggests that they have overly stringent underwriting standards, with only the highest creditworthy borrowers able to tap into historically low mortgage interest rates. There could be an upside surprise to sales activity if credit availability is opened to more qualified home buyers who are willing to stay well within budget,” said NAR chief economist Lawrence Yun.

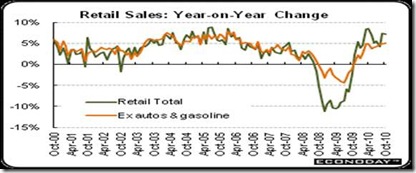

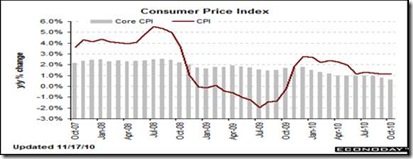

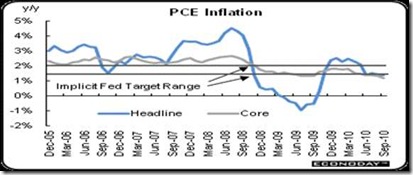

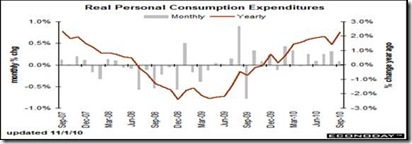

The consumer is making a moderately strong comeback in October in both income and spending. Meanwhile, core inflation is subdued and still too low for Fed comfort. Personal income in October posted a healthy 0.5 percent gain, following no change in September. Income growth topped analysts' forecast for 0.4 percent increase. Importantly, the wages & salaries component jumped 0.6 percent, following a 0.1 percent improvement the month before.

Household spending also showed strength. Personal consumption expenditures rose 0.4 percent, following a 0.3 percent increase in September. For the latest month, strength was led by a 1.9 percent monthly spike in durables. Nondurables advanced 0.8 percent while services edged up 0.1 percent.

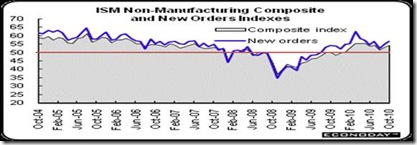

The bottom line? If consumers continue to consume as much as during this holiday season, employers will hire more employees, which leads to more housing sales and higher prices. So we see slow and steady improvement and a return to normalcy in real estate sales and values over the next 3 years.

Harlan Green © 2010