Financial FAQs

The stock and bond markets are sinking because of Fed Chairman Bernanke’s seemingly offhand remark that the Fed could slow down its QE purchases of securities as early as its June FOMC meeting. Now Organization for Economic Development and Cooperation (OECD) economists are saying that could hurt worldwide growth! Of course it will, since the U.S. is leading the worldwide recovery from the Great Recession, while our own economy is only beginning to recover. And we know from past history it takes many years to recover from such a severe downturn.

Why? The huge transfer of wealth upward has to be reversed, as it was after the Great Depression when income inequality was as bad as it is today. And that takes time. It took 10 years plus a World War in the case of the Great Depression, after Roosevelt tried to prematurely balance the federal budget in 1937, plunging the U.S. economy back into depression, hence making it the Great Depression.

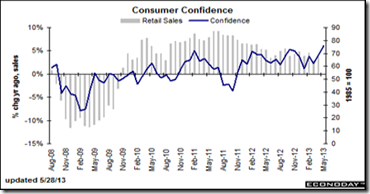

There is a danger this could be repeated. Already the second Q1 2013 estimate of Growth Domestic Product growth revised growth downward to 2.4 percent from its 2.5 percent initial estimate. Even though consumer spending was revised up to 3.4 percent from 3.2 percent, it didn’t offset the reduction in government spending. The 2.4 percent rate is certainly ok, but it’s not enough to lower the unemployment rate that is currently 7.5 percent with 18 million workers still looking for full time work.

This is because consumers aren’t earning enough money to boost the demand for what is being produced. This is something that so-called Austerians, those who don’t like debt of any kind, can’t seem to understand. Because they believe that high debt is always the problem. Even during a time when borrowing isn’t the problem. That is to say, during a time when not enough is being purchased in the private sector to stimulate higher growth.

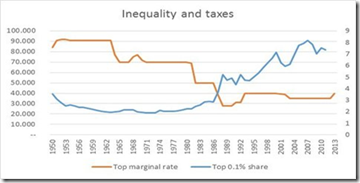

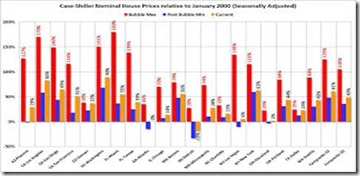

And we know why incomes have been stagnant or falling for most consumers. The collective bargaining of most employees has been severely weakened, or even banned in the case of public workers in states like Wisconsin. Pro-labor laws have been rolled back over the past 30 years that has resulted in record corporate profits and record income inequality not seen since the 1929 Black Market crash.

This is while tax rates for the wealthiest have been slashed, creating more income flowing away from most consumers. A recent National Bureau of Economic Research paper in fact shows that the more top tax rates are cut, the greater the share of national income is diverted to the wealthiest citizens.

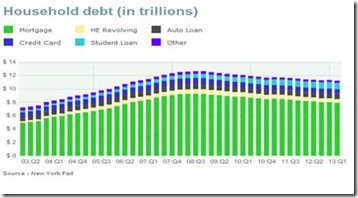

Nobelist Paul Krugman said it best in disputing the Austerians. Inflation is almost nonexistent, having dropped to 1 percent in the GDP revision. Why is low inflation a problem, he asks? “One answer is that it discourages borrowing and spending and encourages sitting on cash. Since our biggest economic problem is an overall lack of demand, falling inflation makes that problem worse. Low inflation also makes it harder to pay down debt, worsening the private-sector debt troubles that are a main reason overall demand is too low.”

This is at the heart of the Austerians misconception. Money is hoarded rather than spent when demand is low and inflation falling. And households won’t spend more if they are intent on paying down debts.

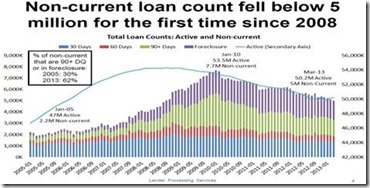

The banks are holding some $1 trillion in excess reserves, while corporations are sitting on almost $5 trillion in cash, according to the Federal Reserve Bank of St. Louis. So why is inflation falling? Krugman says “The answer is the economy’s persistent weakness, which keeps workers from bargaining for higher wages and forces many businesses to cut prices. And if you think about it for a minute, you realize that this is a vicious circle, in which a weak economy leads to too-low inflation, which perpetuates the economy’s weakness.”

And that is our current problem that could lead us back into the Great Recession, or even make it the Lesser Depression. Government spending has been cut back due to the Sequester agreement, while taxes have been raised on must of US. There is really only one solution to weak demand. Less money has to flow to the top income earners, whether through rising the maximum income tax brackets, or closing some corporate tax loopholes, or a combination of both.

Otherwise, we once again will be doomed to repeat a historic mistake—not putting our wealth where it will do the most good, whether that is repairing our obsolete infrastructure, in education, protecting the environment, or even saving social security .

Harlan Green © 2013

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen