Financial FAQs

Santa Barbara voters have an upcoming ballot measure that bans all forms of enhanced drilling techniques, including steam injection and fracking, and it is getting national attention. Fracking supporters tout the huge boost in national oil and gas production that franking, or hydraulic fracturing of shale oil deposits to make extraction possible, that is making the U.S. more independent of foreign oil and gas..

But it is the well-documented loss of property values for those properties close to fracking sites, due to lax environmental regulations that govern fracking operations, that may be the biggest concern for Santa Barbara County voters in November. Nearly 7,000 new wells are proposed locally.

The loss of property values comes from the 24/7 operation of fracking sites that generates so much pollution. Twenty-four hour, day-for-night lighting is required on the rigs, as well as noise and truck traffic from the transportation of the chemicals used—some toxic—in the drilling operation. But there are also fears of ground water contamination from toxic chemicals being injected into the wells.

And fracking operations are non-stop, thanks to the “Halliburton Loophole”, a 2005 amendment to the Clean Air and Water Acts that former VP Dick Cheney, former Halliburton CEO, pushed through Congress exempting fracking operations from almost all Environmental Protection Agency regulations.

“Coupled with existing exemptions to a variety of pollution laws like the Clean Air Act, the Resource Conservation and Recovery Act, the Superfund Act, and the Emergency Planning and Community Right to Know Act, the 2005 carve-outs gave the fracking industry seven total exemptions from important environmental regulations,” reported a recent truthout.org article.

And Congress has not as yet been able to close any of those exemptions. Even former congressional allies of Cheney, such as House Majority Leader Dick Armey, are regretting the Halliburton Loophole they supported at the time. Mr. Armey is one of the plaintiffs now suing the drilling companies that are causing loss of property values in his own Texas backyard from fracking operations.

California already has a thriving fracking industry. The majority of the state’s new and active wells are concentrated in Kern and Los Angeles counties, said a National Resource Defense Council report entitled Drilling in California: Who’s at Risk? However, expanded fracking in the large Monterey Formation could bring the oil and gas industry into more communities, especially in Ventura, Monterey, Fresno and Santa Barbara counties.

The NRDC report reveals that 14 percent of the state’s population—5.4 million Californians—already lives within a mile of at least one oil or gas well. Of that group, 69 percent—3.7 million residents—are people of color (45 percent Latino/Hispanic, 13 percent Asian, 8 percent African American and 3 percent other).

No less than business friendly Forbes Magazine published a study documenting the loss of property values from hydraulic fracturing for those property-owners near fracking sites, with the headline Pollution Fears Crush Home Prices Near Fracking Wells.

“Researchers from the University of Calgary and Duke University studied property sales from 1994 to 2012 in 36 Pennsylvania counties and seven counties in New York,” said Forbes in describing the study. “They mapped sales against the locations of shale-gas wells, and they compared homes connected to public drinking-water systems to homes with private wells.

“Properties with private wells suffered a loss in value compared to properties connected to a municipal water system, they found, offsetting gains in value from mineral-rights royalties. The loss varied with distance from the nearest shale-gas well. At 1.5 kilometers, properties with private wells sold for about 10 percent less.”

Properties suffered greater losses when closer to shale-gas wells where hydraulic fracturing had been employed. Within 1 km of shale gas wells, properties with private drinking water wells dropped 22 percent in value. Properties connected to public water suffered no losses, but also showed no net gains.

There are a host of factors that cause this, said the study, from the noise and toxic smells of fracking machinery (methane and sometimes Hydrogen Sulfide gases are released), to growing evidence of pollution of ground water from the toxic chemicals used. Sulfuric acid is one of the chemicals used to dissolve the oil-bearing shale.

And then there’s the real danger of earthquakes from injecting waste water back into the ground, which have been occurring with increasing frequency in some Oklahoma fracking fields, reports NPR Radio in a July 2014 broadcast by Linda Wertheimer.

Denver, Colorado had the same problems with so-called natural gas injection wells back in the 1960s, and played a critical role in discovering the link between forced injection wells and induced earthquakes.

“In the mid-1960s, Denver experienced a series of quakes believed to have been caused by a 12,000-foot deep wastewater disposal well at Rocky Mountain Arsenal, according to a June 2014 report by Denver’s NBC Channel 9. It culminated in a 5.3 magnitude quake on August 9, 1967 that remains the strongest recorded earthquake in Denver's history, after which the well was decommissioned and the Army began to remove the wastewater it had pumped below the surface.

There are currently more than 1.1 million active oil and gas wells in the United States, and more than 15 million Americans now live within a mile of the hundreds of thousands that have been drilled since 2000, according to an analysis by the Wall Street Journal. Made possible by the advent of fracking, drilling is taking place in shale formations from California to New York and from Wyoming to Texas.

And there’s no indication that this “unprecedented industrialization” shows any signs of slowing. Almost 47,000 new oil and natural gas wells were drilled in 2012, and industry analysts project that pace will only continue.

Even Exxon CEO and board chairman Rex Tillerson, is suing to stop construction of a water tower that would supply nearby drilling operations because of the nuisance of, among other things, heavy truck traffic, noise and traffic hazards from the fracking operations the tower would support.

So the CEO of the single largest drilling company in the world acknowledges the “constant and unbearable nuisance” that would come from having “lights on at all hours of the night …traffic at unreasonable hours … noise from mechanical and electrical equipment.” And Tillerson’s lawsuit – filed in 2013 with other plaintiffs, including former House Majority Leader Dick Armey – claims the project would do “irreparable harm” to his property values, in papers filed for the Denton County, Texas lawsuit.

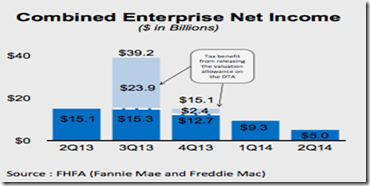

One little noticed side effect is that the secondary mortgage market hasn’t caught up with the risk of loaning on properties affecting by fracking, which means such properties could be harder to finance. Housing Wire has reported on a webinar entitled, “Oil and Gas Exploration for Mortgage Bankers,” in which Daniel McKenna, with the Ballard Spahr’s Mortgage Banking Group said, “The loans are actually low risk. But Fannie, Freddie, the FHA and the VA prohibit gas leases on their loans. There are a ton of different regulations that impact selling these loans on the secondary market.”

The Calgary and Duke University study of property values near shale gas wells has caused a 10 percent drop in values, but with fracking operations, values dropped some 22 percent in value. So it does look like the “Halliburton Loophole” that exempts the fracking industry from almost all environmental regulations will make Californians, a notoriously environmentally-friendly state, wary of allowing it to operate closer to population centers, at the very least.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen