Popular Economics Weekly

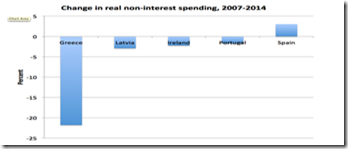

Federal Reserve Chairperson Yellen wants to keep interest rates as low as possible for at least the “next couple of FOMC meetings”, even as there are signs that economic growth is accelerating. This is in the face of the newly Republican-dominated Congress threatening to curb its powers, because their deficit hawks want to raise rates sooner, and we know what happened in Europe and Japan when this happened—their 2nd and 3rd recessions since 2008.

Why? Because raising rates too soon could stop many consumers from spending, because income growth is poor and consumers are only beginning to feel confident enough to spend. Whereas the deficit hawks see inflation where there is none at the moment, since they are mainly creditors that see any deficit as endangering the value of the debt they hold.

Yellen said inflation measures still show inflation too low to sustain growth, and wage pressures are still not enough to sustain higher household incomes, which is the main driver of inflation. Or, in her words, the Fed doesn’t want to raise rates “until the economy is fully healed”

However, “If economic conditions continue to improve,” said Dr. Yellen, “as the Committee anticipates, the Committee will at some point begin considering an increase in the target range for the federal funds rate on a meeting-by-meeting basis. …However, it is important to emphasize that a modification of the forward guidance should not be read as indicating that the Committee will necessarily increase the target range in a couple of meetings.”

The most recent measures do show accelerating growth. For instance, the Chicago Fed National Activity Index (CFNAI), a proxy for nationwide growth, edged up to +0.13 in January from –0.07 in December. It is one of the broadest measures of economic activity, outside of the Gross Domestic Product quarterly report. Three of its four broad categories of indicators that make up the index increased from December, and only one of the four categories made a negative contribution to the index in January.

Too low inflation still remains a problem, you say? Yes, and is the main reason Yellen wants to keep interest rates at their lowest level. It’s now negative for the first time in the year, and even since 2009. There was another huge drop in energy prices. Overall consumer price inflation fell sharp 0.7 after declining 0.3 percent in December. Energy plunged 9.7 percent after dropping 4.7 percent in December.

Gasoline plummeted 18.7 percent, following a 9.2 percent fall in December. Food prices were unchanged, following a rise of 0.2 percent in the previous month. Core inflation excluding food and energy was just 0.2 percent after a modest 0.1 percent rise December, and is up 1.6 percent in a year.

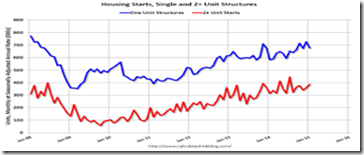

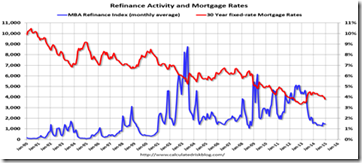

That is the main reason the Fed wants to keep rates low as long as possible. Low interest rates boost both housing prices and sales, lower debt levels, and higher valuations enable more homeowners to sell, refinance, and move, if necessary. So Yellen’s last two days of testimony should encourage those fence sitters, as well as give all consumers more confidence in their future economic well-being.

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen