"Sales of new single-family houses in March 2015 were at a seasonally adjusted annual rate of 481,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.4 percent below the revised February rate of 543,000, but is 19.4 percent above the March 2014 estimate of 403,000."

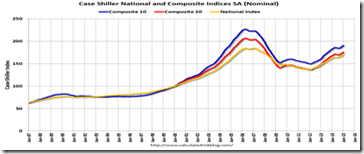

The March result was a disappointment, mainly in the south, where sales fell 15.8 percent. And because builders continue to build—housing starts are close to the million unit mark again—housing inventories are rising and prices are falling. The supply of new homes rose to 5.3 months, while the median price fell to 1.5 percent to $277,400. Year-on-year, the median price to down 1.7 percent while sales are up 19.4 percent, a discrepancy that points to price discounting by builders, says Calculated Risk.

What is behind the up and down gyration in sales? Winter is still with us, for one thing. And many of the southern and Midwest states are being pounded by tornadoes, as well as torrential rains. Lower oil prices could also be hurting an area heavily dependent on the oil and gas industries.

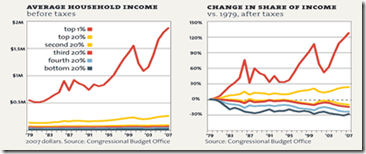

We will know next week if job creation will resume from February’s low numbers, and so consumer confidence remains high. Mortgage activity is high, highest level in years, what with interest rates still at record lows. (The 10-year Treasury yield is back down to 1.91 percent, and Eurozone bonds now have negative interest rates, meaning banks have to pay their clients to borrow money, because there is so little demand for loans.)

Mortgage applications increased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey for the week ending April 17, 2015. The Market Composite Index, a measure of mortgage loan application volume, increased 2.3 percent on a seasonally adjusted basis from one week earlier. The seasonally adjusted Purchase Index increased 5 percent from one week earlier to its highest level since June 2013. The unadjusted Purchase Index increased 6 percent compared with the previous week and was 16 percent higher than the same week one year ago.

"Purchase applications increased for the fourth time in five weeks as we proceed further into the spring home buying season. Despite mortgage rates below four percent, refinance activity increased less than one percent from the previous week," said Mike Fratantoni, MBA's Chief Economist.

The fact that purchase mortgage applications now comprise 44 percent of all applications, the highest in years, as we said, means the Fed’s policy of keeping interest rates as low as possible until household incomes begin to rise again is the right policy to kick start the housing market, and bring in those first time homebuyers who have been renting until know.

It also means some overbuilding of new homes is necessary to build up housing inventories for sale, and thus keep home prices in the affordable range.

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen