The Mortgage Corner

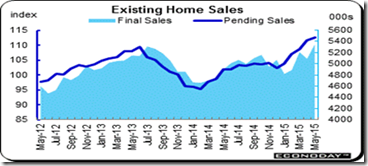

Home prices have stabilized for a while, after the 2013 double-digit price surge brought on by the Fed’s various QE bond purchases and ultra-low interest rates. And homeownership rates are still dropping due mainly to affordability and lack of supply, but homeownership might improve as more new homes are being built and inventories increasing after several years of skimpy supplies.

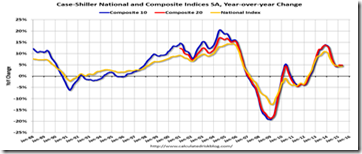

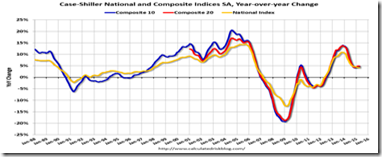

The S&P/Case-Shiller U.S. National Home Price Index, covering all nine U.S. census divisions, recorded a 4.4 percent annual increase in May 2015 versus a 4.3 percent increase in April 2015.The 10-City Composite and National indices showed slightly higher year-over-year gains while the 20-City Composite had marginally lower year-over-year gains when compared to last month. The 10-City Composite gained 4.7 percent year-over-year, while the 20-City Composite gained 4.9 percent year-over-year.

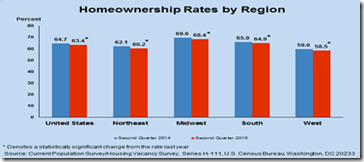

And home ownership rates continue to decline, perhaps because the newer generation of entry-level householders either prefer to rent or cannot yet afford to buy a home. The US Census Bureau reported the second quarter 2015 homeownership rate dropped to 63.4 percent from 64.7 percent in Q2 2014.

Graph: Census Bureau

We know more people are renting because housing vacancy rates are falling for both rental and homeowner housing; down 0.7 percent to 6.8 percent nationally for rentals, and to 1.8 percent for owned housing. Homeownership rates were highest in the Midwest (68.4 percent) and lowest in the West (58.5 percent). The homeownership rates in the Northeast, Midwest, South and West were lower than the rates in the second quarter 2014.

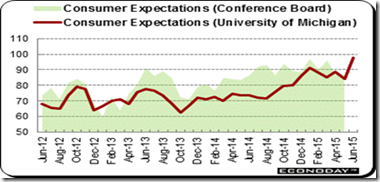

There is some optimism that homeownership rates will rise, though, as household formation returns to its historical 1 million plus per year rate. The Harvard Joint Center for Housing Studies predicts some 1.2 million households per year will be formed over the next ten years, up from the current low levels spawned mostly by the Great Recession.

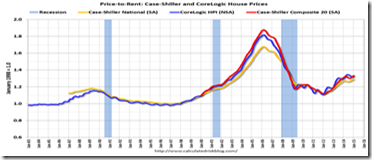

One obstacle to greater homeownership will be affordability, however, until inventories are replenished. This Calculated Risk Price-to-Rent ratio graph shows how prices are rising again in relation to rents. And when price rises outdistance rent increases over an extended period, a housing bubble ensues, as can be seen from the peak formed just before the Great Recession (large gray bar on graph).

But the Price-to-Rent ration seems to be leveling off, in part because rents are rising as well. And as rents continue to rise, it will motivate more renters to buy. And the recent increase in building permits and housing construction should help keep more homes affordable for those first-time homebuyers that want to buy.

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen