What should we be looking for in Friday’s upcoming unemployment report? We hope that the torrid hiring pace—1.7 million nonfarm payroll jobs created in just the last three months—will continue a bit longer, despite the Ukraine invasion and high inflation that might cause consumers to cut back on their spending ways.

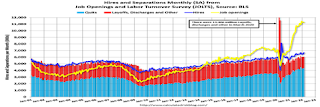

Tuesday’s JOLTS survey of available jobs reported there were still 11.3 million job openings. Hires edged up to 6.7 million while total separations were little changed at 6.1 million. The number of job openings (yellow) were up 43% year-over-year, a very good sign.

This should tell us there will be a strong official employment number Friday, because so-called quits were up 27% year-over-year, which is a sign that workers are finding better jobs. These are voluntary separations. (See light blue columns at bottom of graph for trend for "quits").

How much longer will inflation be a problem with the Ukraine invasion and soaring gas prices? The two major consumer confidence indexes give us a hint of what inflation level consumers are expecting. But there’s a difference in their thinking—short term pessimism that inflation is too high vs. long term optimism that it will come back down. This is one read that says consumers are expecting the U.S. economy longer term is going in the right direction.

The Conference Board’s monthly confidence survey was the most upbeat.

“Consumer confidence was up slightly in March after declines in February and January,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The Present Situation Index rose substantially, suggesting economic growth continued into late Q1. Expectations, on the other hand, weakened further with consumers citing rising prices, especially at the gas pump, and the war in Ukraine as factors. Meanwhile, purchasing intentions for big-ticket items like automobiles have softened somewhat over the past few months as expectations for interest rates have risen.”

The ‘other’, University of Michigan consumer sentiment survey was not so upbeat. It said its respondents think inflation will remain high over the next year but come down to a more normal level over the next 5 years.

“Consumer Sentiment remained largely unchanged in late March at the same diminished level recorded at mid-month,” said U of Michigan chief economist Richard Curtin. “Inflation has been the primary cause of rising pessimism, with an expected year-ahead inflation rate at 5.4%, the highest since November 1981.”

The difference in short and long term outlooks is remarkable and why the Federal Reserve believes higher inflation is transitory, based more on a shortage of products rather than soaring wage inflation, which would be a sign of the dreaded stagflation that occurred during the 1970s.

So, should policy makers be worried more about the short-term, rather than long-term inflation outlook?

Worrying too much about near term trends can lead to hasty actions, like raising interest rates prematurely to restrict available credit when there’s the possibility of a prolonged war in the Ukraine and we need markets to be as liquid as possible to weather the storm.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen