Orders for U.S. durable goods—long-lasting goods such as computers and cars rose in March, and business investment rebounded after the first decline in a year, signaling that the U.S. economic activity is still on a growth path, despite the Ukraine invasion and record inflation. Who knows what will happen with energy prices?

Orders advanced for the sixth time in the last seven months. What’s more, the initially reported 2.2 percent decline in new orders in February was revised to show a smaller 1.7 percent drop, the government said Tuesday.

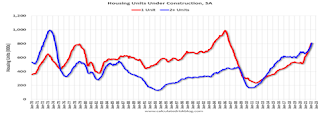

Businesses are investing more (see graph) because they are upbeat about future growth.

And inflation may be peaking with the Federal Reserve’s preferred inflation gauge—the PCE index. Over the past 12 months, the personal consumption price index has climbed 6.6 percent, up from 6.4 percent in February, the government said Friday. That’s the steepest increase since 1981.

Yet a narrower measure of inflation that omits volatile food and energy costs, known as the core PCE, rose by just 0.3 percent in March for the second month in a row. That matched the Wall Street forecast. What’s more, the rate of core inflation in the past year slipped to 5.2 percent from 5.3 percent, marking the first month-to-month decline in more than a year.

This is huge folks. It’s almost as if U.S. businesses don’t see problems ahead with energy shortages because of a prolonged Ukrainian war—for the U.S. economy, at least. Business investment has increased 10 percent in the past year and there’s little evidence that companies are sharply cutting back.

And consumers’ strong demand for durable goods is a sign they are not so pessimistic. While some data from the Conference Board’s consumer confidence survey showed a dip in consumer confidence this month, households were eager to buy big-ticket items like motor vehicles, television sets and clothing dryers within six months.

Consumers were also inclined to buy a house, despite surging mortgage rates and record home prices.

“Consumer confidence fell slightly in April, after a modest increase in March,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “The Present Situation Index declined, but remains quite high, suggesting the economy continued to expand in early Q2. Expectations, while still weak, did not deteriorate further amid high prices, especially at the gas pump, and the war in Ukraine. Vacation intentions cooled but intentions to buy big-ticket items like automobiles and many appliances rose somewhat.”

The Conference Board’s Index of Leading Economic Indicators (LEI) is another measure that is showing strong growth ahead, despite the growing pessimism among economists that those ‘headwinds’ we’ve talked about (interest rates, energy shortages, inflation, war, etc.) could slowdown growth or bring it to a screeching halt sometime next year.

The ten components of The Conference Board Leading Economic Index® for the U.S. cover a broad swath of economic activity, including: Average weekly hours in manufacturing; Average weekly initial claims for unemployment insurance; Manufacturers’ new orders for consumer goods and materials; ISM® Index of New Orders; and even Building permits for new private housing units.

And all components continue to trend upward.

“The US LEI rose again in March despite headwinds from the war in Ukraine,” said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board. “This broad-based improvement signals economic growth is likely to continue through 2022 despite volatile stock prices and weakening business and consumer expectations. The Conference Board projects 3.0 percent year-over-year US GDP growth in 2022, which is slower than the 5.6 percent pace of 2021, but still well above pre-covid trend.”

So, by investing in their future, businesses are betting on a better future for Americans.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen