As a precursor to July’s unemployment report, the Labor Department’s JOLTS report that measures the number of job openings—jobs waiting to be filled—has just come out. The number of openings is still the highest in decades, per the FRED graph (it peaked during the pandemic shutdown).

“The number of job openings was unchanged at 8.2 million on the last business day of June, the U.S. Bureau of Labor Statistics reported. Over the month, both the number of hires and total separations were little changed at 5.3 million and 5.1 million, respectively.”

This means there aren’t enough workers to fill those 8.2 million job openings and 5.3 million hires in June. Our economy remains fully employed, despite the Fed’s attempts to restrict the number of hires by keeping interest rates high.

Why do they want higher unemployment when one of the Fed’s twin mandates is maximum employment (with stable inflation)? Because many of the Fed Governors seem to subscribe to an economic theory from the 1970s by the conservative Nobel Prize Economist Milton Friedman who postulated that the amount of money in circulation controls economic activity. Therefore the Fed has reasoned keeping interest rates high will slow growth enough to control inflation.

But this inflationary surge was caused by worldwide supply shortages from the pandemic shutdown that led to a temporary inflation surge, not too much money in circulation. Inflation has declined despite the abundance of money still in circulation to pay for our economic renewal— infrastructure projects and computer chip factories, for starters—for which $trillions are needed.

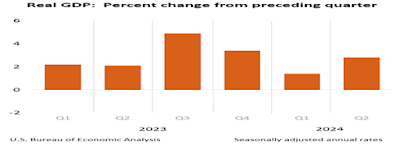

The inflation decline has been corroborated while second quarter GDP growth doubled from 1.4 percent to 2.8 percent, I reported last week. Despite such a growth surge, its price index for gross domestic purchases increased just 2.3 percent in the second quarter, compared with an increase of 3.1 percent in the first quarter. The personal consumption expenditures (PCE) price index increased just 2.6 percent, compared with an increase of 3.4 percent in Q1.

These declining inflation rates are telling us it’s time for a rate drop. But are consumers getting the message? The Fed’s money tightening has been making consumers more cautious in their outlook but they aren’t seeing much light at the end of the inflation tunnel. The Conference Board’s latest Consumer Confidence Index is still showing pessimism.

Conference Board Chief Economist Dana Peterson said in its latest release, ““The proportion of consumers predicting a forthcoming recession ticked up in July but remains well below the 2023 peak. Consumers’ assessments of their Family’s Financial Situation—both currently and over the next six months—was less positive. Indeed, assessments of familial finances have deteriorated continuously since the beginning of 2024.”

Consumers shouldn’t be blamed for their pessimism, despite being fully employed. Prices are still 20 percent higher on average than before the pandemic. But their moods should considerably improve when the Fed finally begins to cut interest rates, and their fears lesson of an upcoming recession.

We are at the beginning, not the end of the post-pandemic recovery, in other words, which could continue for most of this decade and is generating many new high-paying jobs.

Harlan Green © 2024

Harlan Green on Twitter: https://twitter.com/HarlanGreen