The S&P/Case-Shiller Home Price Index, a leading measure of U.S. same-home prices, show that the 10-City Composite is up 4.1 percent and the 20-City Composite is up 3.2 percent from where they were in July 2009, though the annual increases slowed in July compared to June 2010.

In fact, 12 cities’ prices are higher than July 2009, with the largest increases in San Francisco, San Diego, Los Angeles, and Washington, as those markets continue to grow. The largest year-over-year declines were in Las Vegas, Tampa, and Charlotte, NC.

The best news on housing showed up in the housing starts report. Housing construction was unexpectedly strong in August as starts jumped 10.5 percent after rising a modest 0.4 percent in July. The August annualized pace of 0.598 million units sharply topped analysts’ expectations for 0.550 million units and is actually up 2.2 percent on a year-ago basis.

NAR chief economist Lawrence Yun said, “The housing market is trying to recover on its own power without the home buyer tax credit. Despite very attractive affordability conditions, a housing market recovery will likely be slow and gradual because of lingering economic uncertainty”.

The gain in August was led by a 32.2 percent surge in multifamily starts, following a 36.0 percent increase in July. The single-family component rebounded a far more moderate 4.3 percent after dipping 6.7 percent in July.

This appears to be a pattern elsewhere—the single-family component is not showing as much life as the multifamily component. The bottom line, says Econoday, is that the starts report was probably better news for construction workers than for real estate brokers.

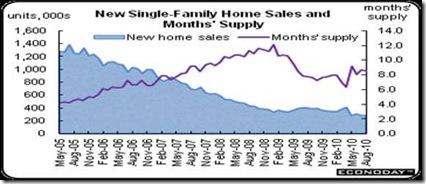

We are seeing very little bounce in new home sales following the drop in May after the April deadline for special tax credits. New home sales were unchanged in August at a 288,000 annual unit rate but were up from the initial estimate for July of 276,000. With the exception of June sales coming in at 312,000, recent months have been only barely above the series low of 282,000 set in May of this year.

Further proof that the lower end of the market has weakened was that the FHFA price index for existing homes with conforming loan amounts to $417,000 had slipped further. House prices are back on a downtrend after tax credit induced gains earlier in the year. The Federal Housing Finance Agency’s (FHFA) purchase only house price index slipped 0.5 percent in July after declining a revised 1.2 percent the month before. FHFA said the downward revision was due to much weaker prices late in the month that had not yet been reported. Prices had risen over the February through April period as purchases heated up prior to the end of April deadline for qualifying for special tax credits. But distressed sales have been rising, and RealtyTrac says now make up 25 percent of all existing-home sales.

The NBER’s Business Cycle Dating Committee decided the Great Recession ended in June 2009 and, "The committee decided that any future downturn of the economy would be a new recession and not a continuation of the recession that began in December 2007. The basis for this decision was the length and strength of the recovery to date."

So why did it take so long to make that announcement? Because it was looking at quarterly data, rather than monthly data to even out the swings. And since GDP data is quarterly, GDP began to grow again in June. But the NBER apparently wanted to wait 6 quarters—18 months—to make sure it wouldn’t dip again. It also shows how extreme were the job losses—much worse than in 2001.

The Fed really has no choice but to continue to stimulate growth, as that is the only way we will dig ourselves out of debt without greater job formation. Cutting spending also cuts revenues, digging us deeper into the whole.

Harlan Green © 2010

![clip_image002[8] clip_image002[8]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhX-She4YKtEhdySfTFd_FYzBccKRpCsOTezeh6JHinVPo6YvGe1Tvav4uf-o6dIeJ1x2z8UQ_sxMaYTDINWP3ePC7y4c9pOa4Z1_mmHySIWePhr-p6WkeBKvwEZwZms48LxY-88zFWIA/?imgmax=800)