Popular Economics Weekly

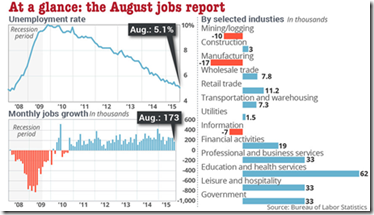

The Federal Reserve didn’t raise interest rates today at the close of their FOMC meeting. In fact the 9-1 vote against raising rates wasn’t even close. So don’t count on inflation to save the day for the deficit hawks demanding that the Fed must raise interest rates.

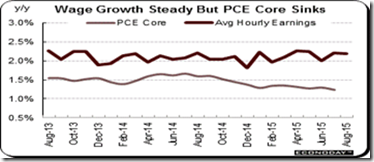

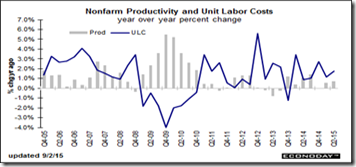

Inflation is not imminent or even possible in today’s low demand, slow growth, and world-wide economies. It ain’t going to happen. Inflation won’t happen, not only because the Asian tigers are overproducing and under pricing everything—hence China’s problem—or that many economists now believe in the so-called ‘new normal’ of slower economic growth model, due to slowing population and labor productivity growth.

Here is the U.S. CPI, or retail inflation rate. It’s basically zero or negative, and has been since January 2015.

The eurozone’s inflation rate is no higher, in spite of their Austerians’ (read German) insistence that it’s right around the corner (if only growth would increase). It experienced its second recession in 2011, and growth hasn’t really recovered with an 11 percent plus average unemployment rate throughout the eurozone, except in Germany.

Graph: Trading Economics

Because it’s as much due to misguided government policies by the modern Austerians that have stopped eurozone growth by demanding draconian cuts in government spending and budget deficits that would create growth. But U.S. austerity advocates have damaged our growth, as well, with measures such as our current sequester agreement that caps government spending.

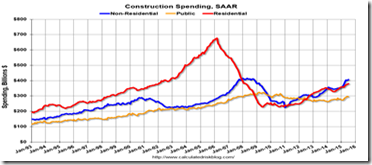

The result is very little investment in the areas that increase future growth, such as modernizing public infrastructure, increasing educational opportunities, and Research & Development that got us to the moon and created the Internet.

Yes, it is those politicians and the economists supporting them that are destroying our seed corn that nurtures future growth. There is no incipient inflation, nor will there be for years to come. The disinflationary spiral world economies are currently experiencing are due as much to misplaced policies and ideologies that don’t create growth as to slower population growth in the developed economies.

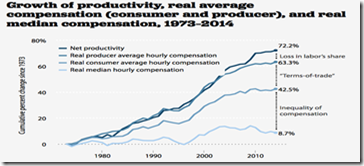

How then will those that want to continue the trickle down economic policies that say only the wealthiest are able to create more growth with their $Trillions, to justify transferring so much of the nation’s wealth to those overpaid CEOs and hedge fund managers?

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen