The Mortgage Corner

The 30-year fixed rate conforming mortgage rate fell to a 1-year low, according to Freddie Mac, the GSE still in government conservatorship, and major purchaser of conforming conventional mortgages. The 30-year fixed-rate averaged 4.35 percent in the February 21 week, mortgage giant Freddie Mac said last Thursday. That was down from 4.37 percent in the prior week and the lowest since early February 2018.

In fact, the 10-year Treasury yield on which mortgage rates depend has not been this low since the 1950s, when money was plentiful and U.S. economic growth was phenomenal, reaching 6 and 7 percent GDP growth rates after WWII.

What will this do for the housing market, which has shown signs of life after last year’s marked slowdown? It will depend on interest rates remaining at this record level over the longer term, which shouldn’t be happening at this late stage of the current recovery. I discussed its effect on the rise in construction and new-home sales last week.

"After two lackluster months, new home sales surged...in January to the fastest pace in our survey, dating back to 2013," said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. "Despite the jitters potential homebuyers felt in December from the volatility in the financial markets, the healthy job market and wage growth, moderating price gains and lower mortgage rates all helped home sales recover. Additionally, builders seem to be seeing improvement in their labor shortages, as recently released government survey data showed increases in construction hiring and openings in December."Not enough attention is being paid to why interest rates are at this level again at a time of full employment and last year’s growth spurt, which should put a strain on the available money supply, but hasn’t done so. It could be a sign of slowing growth.

There is almost no sign of incipient inflation, in other words, which has caused the Fed to back off on further rate increases. Or put another way, there is a disinflationary environment affecting many of the worlds’ developed economies today that have zero or negative sovereign debt yields. This has brought back memories of the Great Depression when so-called aggregate demand—the demand by consumers, government and foreigners for U.S. products—fell into negative territory, memories that caused recent Fed Chairman ‘helicopter’ Ben Bernanke to shower the U.S. economy with cash by buying up U.S. securities in various QE programs to mitigate the effects of the Great Recession.

This had the desired effect of keeping interest rates at post-WWII lows, aiding in the recovery from the Great Recession and housing bust. But why has it also kept inflation at multi-decade lows? Many conservative economists and deficit hawks predicted runaway inflation at the time.

Japan experienced outright deflation during several lost decades under similar circumstances—of falling wages, as well as prices. This meant that Japanese consumers’ purchasing ability also shrank drastically, which caused economic growth to decline into several recessions in recent decades.

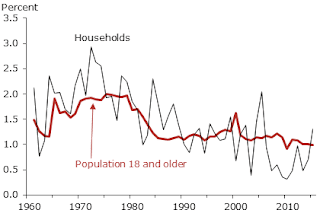

Then, as now, the real culprit must be the lack of household income growth, which has remained static since the 1970s, after inflation. It should be a truism that if consumers’ incomes don’t rise faster than inflation, then there isn’t sufficient demand to boost inflation, which in small doses actually aids economic growth.

That brings up the other major cause—a worldwide savings glut that isn’t being invested productively. What would be the best use for some of those savings? Repair and replace the $2.25 trillion in ageing U.S. infrastructure that hasn’t really been upgraded in 75 years, according to the American Society of Civil Engineers. It would boost incomes as well as the productivity of future generations.

What is its worst use? The Trump tax cuts, which haven’t increased either capital expenditures or wages, but went instead into the pockets of stockholders and corporate CEOs, where it does nothing except add to the savings glut, and overpriced stock values.

Nobelist Paul Krugman in a recent NYTimes Op-ed has perhaps best said why there has been no infrastructure spending over the past two years with Republicans controlling government. “The truth is that modern conservatives hate the idea of any kind of new public spending, even if it would make Americans better off — or perhaps it would be more accurate to say especially if it would make Americans better off, because a successful spending program might help legitimize a positive role for government in general. And while Trump may not fully share his party’s small-government ideology, all his limited energy is going into finding ways to punish people, not help them.”So we see that the real reason for record low interest rates and inflation is the outright refusal of conservatives, in particular—both here and in the Eurozone—to make the investments that would bring more prosperity to those working households that need it the most.

Harlan Green © 2019

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen