Financial FAQs

Gross domestic product, the official report card on the economy, grew at a 2.1 percent annual pace from the start of April to the end of June, the government said Friday. GDP slowed from a 3.1 percent gain in the first three months of the year.

American consumers don’t seem to care about signs of slowing growth in manufacturing and housing, as most can find good jobs and rising wages in the service sector of the economy, and they are flush with cash. The BEA reports disposable personal income increased $193.4 billion, or 4.9 percent, in the second quarter, compared with an increase of $190.6 billion, or 4.8 percent, in the first quarter. Real disposable personal income (after inflation is factored in) increased a very impressive 2.5 percent, compared with an increase of 4.4 percent in Q1.

But they are becoming more cautious about the future as the personal saving rate -- personal saving as a percentage of disposable personal income – is at 8.1 percent in the second quarter, compared with 8.5 percent in the first quarter, which are highs for this recovery.

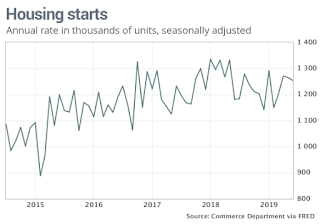

The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE), federal government spending, and state and local government spending that were partly offset by negative contributions from private inventory investment, exports, nonresidential fixed investment and residential fixed investment, said the BEA. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP in the second quarter reflected downturns in inventory investment, exports, and nonresidential fixed investment. These downturns were partly offset by accelerations in PCE and federal government spending.

Economists had been predicting the slowdown for some time, as businesses are investing less this year. Manufacturing is the culprit, as no one wants to invest more in plant and equipment with the ongoing trade wars, as we have been saying. There is too much economic uncertainty in China and the EU, and growth in the rest of the world is also slowing because of the overall decline in foreign trade due to the uncertainties, according to the IMF.

The surge in consumer spending was also predicted by the jump in retail sales reported last week. Retail sales rose in June for the fourth month in a row, quieting concerns that the trade wars and weaker manufacturing output would also drag down consumer spending. The most surprising strength in the report was a 0.7 percent jump in auto sales, which the only component of manufacturing seeing steady growth. Nonretailers (Internet), which continue to feed off of traditional retailers such as department stores, was also surprising with a 1.7 percent for the second month in a row.

So any further decline in GDP growth will probably be due to a slower accumulation of inventories and capital investments (as seen in the above capital-goods orders graph) and a growing negative imbalance in exports vs. imports with the decline in manufacturing.

If the Trump administration and Republicans would realize the damage confrontational trade wars and other fear-mongering policies do to GDP growth, they would end such tactics. But it is obvious they only see an upside in their continuing confrontation with allies and adversaries alike, which should come back to haunt them next year when the inevitable worldwide growth slowdown impacts US, and the Presidential election.

And guess what? The price index for gross domestic purchases increased 2.2 percent in the second quarter, compared with an increase of 0.8 percent in the first quarter, which is a sign of looming inflation, and makes it more unlikely the Fed will want to lower their short term interest rates anytime soon.

Harlan Green © 2019

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen