Answering the Kennedys’ Call

Wikipedia

President-Elect Biden is 78 years old, and will be the oldest President in our history when he is sworn in. He continues to uphold the recent age levels of POTUS set by Donald Trump (74), Presidents Eisenhower, Reagan and GHW Bush that were all over 70 by the time they left office.

The NY Times Ian Philbrick reports that we have the oldest leaders in the western developed countries at a time when the age of elected leaders in other developed countries is falling.

“Since 1950, the average age of heads of government in the three dozen member countries of the Organization for Economic Cooperation and Development has steadily declined, from above 60 years old to around 54 today. The average O.E.C.D. national leader is now two decades younger than Mr. Trump — and almost a quarter century younger than Mr. Biden.”

Why does that matter? I believe it is a major reason for the slow slide into populism and the dysfunctional democracy we currently endure without the increased social and economic benefits enjoyed by citizens of other western developed countries with younger and more forward-looking leaders.

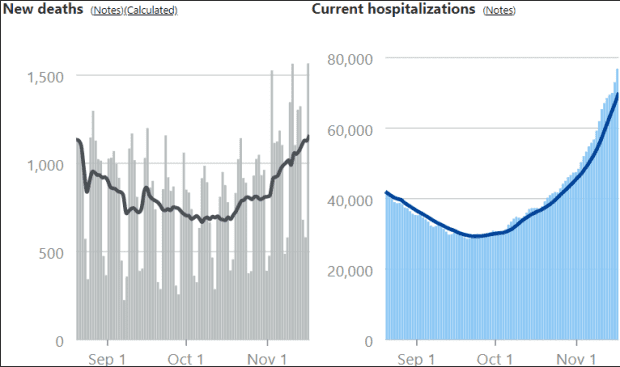

The slide into a federal government led by President Donald Trump that is barely able to function has resulted in our inability to manage the new coronavirus pandemic that is infecting and killing a record number of Americans.

We seem to crave the appearance of strong leadership even if he or she eschews the main requirement of leadership, namely the necessity to keep our 50 different states plus territories, each with its own system of governance, safe and united in common purpose,.

“On a national level, many of us have been seduced by “shiny new objects” – what I call “leadership bling, says Nancy Koehn, a historian at Harvard Business School and the author of the 2017 book, “Forged in Crisis: The Power of Courageous Leadership in Turbulent Times.”Too often, we’re dazzled by personal ambition, reasoning that a person who was born hard-charging and who followed his or her self-interest all the way to enormous wealth, celebrity, or authority has to have accumulated great wisdom.”

The Trump administration’s one legislative accomplishment was the 2017 Tax Cut and Jobs Act that resulted in the first $1 trillion annual budget deficit in our history, while Republicans failed in more than 80 attempts to repeal Obamacare.

Our federal government has become out of touch with younger generations in particular that are almost unanimous in wanting better schools, universal health care, a higher minimum wage, and other benefits now enjoyed by all other developed countries.

A Pew Research Center survey conducted in January of this year found that about a quarter of registered voters ages 18 to 23 (22 percent) approved of how Donald Trump is handling his job as president, while about three-quarters disapproved (77 percent). Millennial voters were only slightly more likely to approve of Trump (32 percent) while 42 percent of Gen X voters, 48 percent of Baby Boomers and 57 percent of those in the Silent Generation approved of the job he is doing as president.

The Times also points out that the average age of Congress has also trended upward for decades. Nancy Pelosi, the House speaker, is 80; Mitch McConnell, the Senate majority leader, is 78. The Supreme Court’s nine justices average above 67. Mr. Trump’s cabinet averages over 60, among the oldest in the O.E.C.D.

Even younger Republicans follow Democrats in wanting more benefits in the PEW survey. Gen Z Republicans, for instance, are much more likely than older generations of Republicans to desire an increased government role in solving problems, says PEW.

“About half (52%) of Republican Gen Zers say government should do more, compared with 38% of Millennials, 29% of Gen Xers and even smaller shares among older generations. And the youngest Republicans are less likely than their older counterparts to attribute the earth’s warming temperatures to natural patterns, as opposed to human activity (18% of Gen Z Republicans say this, compared with three-in-ten or more among older generations of Republicans).”

Looked at in economic terms, our slide into extreme conservatism instituted by Ronald Reagan and the Republican Party with their credo of lower taxes and an unregulated, free market capitalist ideology, is the reason we have a federal government out of touch with most Americans.

Whereas our European cousins enjoy universal health care, higher minimum wages, and shorter work weeks for the same pay; all brought about by keeping their governments young and able to adapt to even a COVID-19 pandemic.

So where are the leaders to come that will bring in programs and policies that will govern for future generations, rather than cater to the populace of the past?

Harlan Green © 2020

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen