The only problem is that government austerity policies pushed through in 2010 when he was elected Wisconsin’s Governor (tax cuts plus lower government spending) don’t work. Especially during such difficult times as now when America still needs to recover from the Great Recession. It’s a lesson from the Great Depression that’s been forgotten, when President Roosevelt’s administration hired 8 million workers to build American public works projects from 1935-43 under the Workers Project Administration.

Almost every community in the United States had a new park, bridge or school constructed by WPA. The WPA's initial appropriation in 1935 was for $4.9 billion (about 6.7 percent of the 1935 GDP), and in total it spent $13.4 billion. Can we imagine what several $trillion in government spending would do today to boost economic growth, instead of the $831billion spent under the 2009 American Recovery and Reinvestment Act?

Wisconsin has gone in the other direction, depriving union workers in particular of incomes and jobs at a time when job creation should be Governor Walker’s priority. That’s why Wisconsin has fallen to the bottom of states in job creation, according to the Bureau of Labor Statistics.

Its beaten down public unions in particular are the poster children for what happens when governments take away workers’ ability to collective bargain, one of the most fundamental rights in any democratic society. The EPI Capital Times graph compares US job creation with national and other Midwestern states.

There is no other power to counteract the monopoly power of governments and private sector businesses. Under Wisconsin’s Act 10 enacted in 2010, which eliminated collective bargaining for most public workers, thousands of government workers have seen smaller paychecks as they are forced to pay more for health care and pensions.

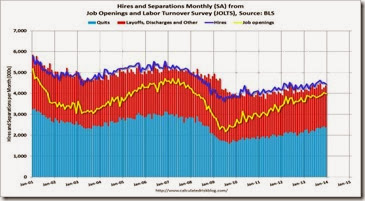

And a new report from the Economic Policy Institute also blames the slow pace of the national recovery on cutbacks in the public sector. Unlike in previous recoveries, state and local government austerity has been a major drag on job growth and the broader economy. The number of public-sector jobs fell by almost 3 percent in the three years following the recession, while the number of private-sector jobs grew (albeit anemically). The fact that public-sector wages have lagged behind those in the private-sector exacerbates government’s drag on the economy, said the EPI report by Heidi Shierholz and Josh Bivens.

This is because austerity—cutting government workers’ wages and salaries in the name of reducing government spending—cuts the overall demand for goods and services. And since government doesn’t make things, decreasing their incomes decreases their ability to buy private sector goods and services, therefore cutting private sector jobs.

You would think small business people, as well as consumers, would understand this. It should be a no-brainer that even Henry Ford understood in 1914, when he upped his employees’ salaries to $5 per day so they could buy more of his Model Ts.

James Couzens, the Ford treasurer, said: “It is our belief that social justice begins at home. We want those who have helped us to produce this great institution and are helping to maintain it to share our prosperity. We want them to have present profits and future prospects. … Believing as we do, that a division of our earnings between capital and labor is unequal, we have sought a plan of relief suitable for our business.”

We are at a similar juncture in history today with record income inequality that has caused the middle class Henry Ford helped to create greatly lose its purchasing power. Who will help them to bring back a government and economy that works for all, which restores a more equal division of earnings and labor, one of our most fundamental rights?