Financial FAQs

Conservatives love to repeat their mantra that economic growth and higher taxes are incapatible. But a very good recent Op-ed by New York Times pollster Charles Blow gave the best description of the result of non-progressive tax policies. The historical picture shows that a lower the tax rate for the richest among us—the so-called highest marginal tax rate—coincided with a lower overall growth rate of our economy. This refutes the tax cutters justification for reducing government services—that the private sector is best engine of growth. In fact, a certain amount of government services are necessary for decent economic growth.

“The spurious argument that cutting taxes for the wealthy will somehow stimulate economic growth is not borne out by the data,” says Mr. Blow. “A look at the year-over-year change in G.D.P. and changes in the historical top marginal tax rates show no such correlation. This isn’t about balancing budgets or fiscal discipline or prosperity-for-posterity stewardship. This is open piracy for plutocrats. This is about reshaping the government and economy to benefit the wealthy and powerful at the expense of the poor and powerless.”

There are other reasons for slower growth, of course. A slower growing population with more seniors, saturated consumer markets (more than 2 cars in a garage?), are two of the reasons. But during the period 1951-63, when marginal rates were at their peak—91 percent or 92 percent—the American economy boomed, growing at an average annual rate of 3.71 percent. The fact that the marginal rates were what would today be viewed as essentially confiscatory did not cause economic cataclysm—just the opposite. Whereas during the past seven years, during which we reduced the top marginal rate to 35 percent, average growth was a more meager 1.71 percent.

Why is there a correlation between slower overall economic growth and a shift in wealth towards the top? The richest invest less of their incomes in either consumption or investments, for starters. This has been shown in many studies. But also, the more unequal wealth distribution was a direct cause of both the Great Recession, and the Great Depression, which had almost identical wealth shifts to the top. The middle and lower class incomes declined at the same time that Wall Street and the banks—proxies for the interests of the wealthiest—agitated for fewer financial controls. In both cases, reduced regulation and the easy credit engineered by the Federal Reserve enabled consumers to borrow beyond their means to keep up their standard of living.

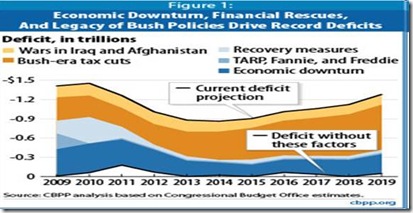

The lower marginal tax rates were also a reason for the burgeoning deficit, and further market instability. So curing the budget deficit is really a common sense matter. We must grow our economy by boosting everyone’s income, in other words, not just that of the wealthiest, while holding our expenses. We did it in the 1990s. That can only happen with increased job formation, and a fairer tax code.

There are many causes of slower economic growth, but only a few ways to boost a recovery in growth. The historical record shows just cutting taxes or lowering the highest marginal tax rate that funnels more money into the pockets of the wealthy, but downsizes public funding for research and development, programs that develop new talent by nurturing educational opportunities, and debases a regulatory environment that prevents excessive risk-taking by Wall Street, leads to slower growth.

Harlan Green © 2011

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiNBeoagJYRzvZfKu2-2fYOnsAyuaZ_z7L1GXzqlGYRgLFOVdNP-wMFG25aUI_qG9dvL0-re2LvwZbTgS1M55D4fHbpsn0YtO7cfEDtTmr5lWfHM8eF_uFcOUoLtkXNvxX3osEsjeGAdg/?imgmax=800)