The Mortgage Corner

Who will benefit from HARP II, the latest attempt at loan modification? President Obama announced in Las Vegas that Fannie Mae and Freddie Mac would loosen their loan modification rules, which could enable up to one million homeowners with Fannie or Freddie-owned loans to reduce their interest rate and/or “accelerate the reduction of principal”.

Since it’s estimated there are up to 11 million homeowners that are ‘underwater’ (have negative equity in their homes), who will this really help? Firstly, it will spur more refinance activity, which means many homeowners might finally be able to sell their homes and move to better job locations. Part of the reason for the 3.1 million job openings according the Labor Department’s JOLTS report is that employers can’t match their skill requirements to the local applicant pool.

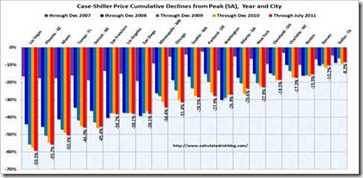

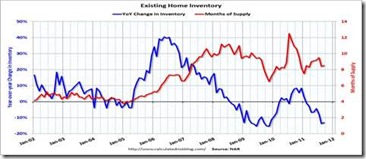

Secondly, it will help the banks that are holding the underwater mortgages by giving more certainty to valuations in their mortgage portfolio. And lastly, it should lower default and foreclose rates, which have been a major reason for RE values continuing to fall.

Graphs: Calculated Risk Blog

The delinquency rate has been declining from its peak of almost 12 percent in 2009 to 8.13 percent in August 2011, but foreclosures are stuck in the low 4 percent range, whereas historical delinquency and default rates were in the 4 and 1 percent range, respectively. Fannie and Freddie’s default and foreclosure rates, on the other hand, have remained within historical levels because of their stricter qualification requirements that have always required income and asset verification.

Calculated Risk’s take is, “What this program does do is remove many of the stumbling blocks to refinancing Fannie and Freddie loans (eliminate reps and warrants, reduce or eliminate fees, automatic 2nd subordination, minimal qualifying). These were all deal killers for HARP, and hopefully these changes will smooth the refinance road.”

Then questions remain on what to do with all the non-agency, or private label securities (PLS). They are where almost all of the subprime mortgages originated by the likes of Countrywide, Bank of American and Wells Fargo remain, and where most of the foreclosures occur.

One solution being worked out by the State Attorneys General, as reported by Jon Prior’s Housing Wire, is a reduction in the principal of the existing mortgage. “As part of the negotiations, the AGs are working to force servicers to refinance current borrowers into lower-rate mortgages,” said Prior. “A source said last week principal reductions were also very much a part of the talks, which some states began to split from, including foreclosure heavy California and New York…”The settlement negotiation is also going to be focused on significantly accelerating the reduction of principal," Department of Housing and Urban Development Secretary Shaun Donovan said Monday.

Pricing details won't be published until mid-November, and lenders could begin refinancing loans under the retooled program as soon as Dec. 1, according to Calculated Risk. Loans that exceed the current limit of 125 percent of the property's value won't be able to participate until early next year. HARP is only open to loans that Fannie and Freddie guaranteed as of June 2009.

How does one find out who qualifies for the HARP II loan modification? The first step is to find out if the borrower has a Fannie or Freddie-owned mortgage. Homeowners can use mortgage “look-up tools” to determine if Fannie or Freddie owns their loan.

Homeowners can also contact their current lender or loan servicer, to find out if the loan is backed by Fannie or Freddie. It’s a key requirement for HARP 2.0 and will likely remain in place throughout 2012, says the Home Buying Institute.

“Put those three programs together: HARP refinance for GSE loans, a HARP like refinance program as part of the mortgage settlement for many non-GSE loans, and an REO dispositions program that keeps many occupants in place as renters and I think that will help,” said Calculated Risk.

Harlan Green © 2011