Popular Economics Weekly

January’s economic numbers are in, so we can say government stimulus spending has worked; there is just not enough of it. Whereas the views of those Paul Krugman characterizes as “confidence fairies” doesn’t work. Austerity and budget cutting during recessions doesn’t boost growth for the simplest of reasons—consumers and private sector businesses can’t spend the money they don’t have.

The confidence fairies so loved by small government types somehow believe when budget deficits are reduced that businesses and consumers will invest and spend more. But how, when workers are laid off and salaries cut to achieve that result? This results in lower incomes, so lower spending, hence lower demand for the very goods and services that would spur growth.

The U.S. now seems to be entering a virtuous growth cycle just because we didn’t follow the advice of the confidence fairies. Increased stimulus spending has increased hiring, causing in turn increased demand, which then spurs more hiring, and so on. Whereas the Eurozone economies are falling into another recession.

Paul Krugman has been telling Europeans what would happen if EU leaders continued to listen to their confidence fairies: “Specifically, in early 2010 austerity economics — the insistence that governments should slash spending even in the face of high unemployment — became all the rage in European capitals. The doctrine asserted that the direct negative effects of 00spending cuts on employment would be offset by changes in “confidence,” that savage spending cuts would lead to a surge in consumer and business spending, while nations failing to make such cuts would see capital flight and soaring interest rates. If this sounds to you like something Herbert Hoover might have said, you’re right: It does and he did.”

So it is our experience with the Great Depression and President Roosevelt’s New Deal that has kept us from following the path of austerity economics, even in the face of continued cries for less government involvement in our recovery. That doesn’t work, as ‘Hoovernomics’ proved. In fact, it was GW Bush’s attempts to follow Hoover’s path that led us into the Great Recession. Bush decided on all those tax breaks, instead of using Clinton’s 4 years of budget surpluses to fix social security and Medicare, resulting in the largest budget deficits since Ronald Reagan, told in telling detail by Bush Treasury Secretary Paul ONeill and Ron Susskind in The Price of Loyalty.

Meanwhile, the U.S. economy continues to grow. Retail sales are one of the best indicators of consumers’ financial health. Excluding autos, retail sales surged 0.7 percent in January after decreasing 0.5 percent in December (due to lower auto sales, said the report). But that may be an anomaly due to a small sampling of auto dealers, because other data show auto sales have been increasing. The Fed’s January Industrial Production report said the output of motor vehicles and parts surged 6.8 percent following an upwardly revised increase of 3.8 percent in December.

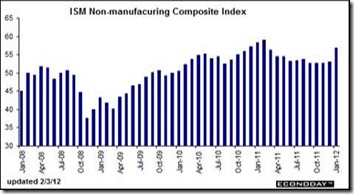

Graph: Econoday

Overall industrial production was unchanged in January after a 1.0 percent jump the month before, but the manufacturing component jumped 0.7 percent, following a 1.5 percent comeback in December. In January, utilities dropped 2.5 percent while mining output declined 1.8 percent, was the reason for overall production being flat. The manufacturing sector was strong in several Fed regions. Both the Empire State (New York Fed), and Philly Fed manufacturing surveys jumped.

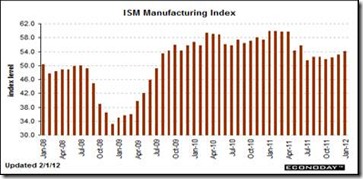

Graph: Econoday

These factors also led the index of leading economic indicators to a solid 0.4 percent gain in January following upwardly revised gains of 0.5 and 0.3 percent in the prior two months. Other areas showing strength in January include credit activity and building permits, gains that underscore the improving outlook for the housing and construction sectors.

Graph: Econoday

What makes me think this is really a virtuous growth cycle, rather than another early-in-the-year spurt that might die later is that the nation's inventories are lean and well managed—meaning there are no headwinds from excess inventories. Business inventories rose a moderate 0.4 percent in December, below the 0.7 percent rise for sales and pulling down the stock-to-sales ratio by 1 tenth to 1.26. That means demand is keeping up with production, since the stock-to-sale ratio hasn’t increased.

Graph: Econoday

“Now the results are in”, says Krugman, “and they’re exactly what three generations’ worth of economic analysis and all the lessons of history should have told you would happen. The confidence fairy has failed to show up: none of the countries slashing spending have seen the predicted private-sector surge. Instead, the depressing effects of fiscal austerity have been reinforced by falling private spending.”

“Look, I understand why influential people are reluctant to admit that policy ideas they thought reflected deep wisdom actually amounted to utter, destructive folly. But it’s time to put delusional beliefs about the virtues of austerity in a depressed economy behind us.”

Harlan Green © 2012