Popular Economics Weekly

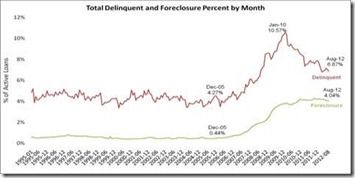

There are many ways to look at the “weak” 2 percent growth numbers for Q3, though just the ‘Advance Estimate’ and so subject to at least 2 more revisions. But such weak growth isn’t due to excessive government regulations (since deregulation has not created greater overall growth, only more recessions). The record low interest rates mean that banks and corporations have too much money to spend, but no place to invest it, since consumers aren’t spending as they used to.

Weak growth over the past decade in particular can mainly be traced to the fall in household incomes, and what consumers can really afford. If their incomes were growing as in 2000 before the Bush tax cuts and wars, for instance, then we would already be back to 1990s levels of economic growth—when 4 to 6 percent annual growth rates were more normal—before the last 2 recessions (gray bars) as the graph shows.

Graph: Calculated Risk

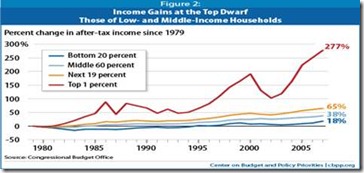

And where has the lost household income flowed, since corporations have the highest profits in history as a percentage of GDP? It has been paid to the investor class and corporate CEOs, in the form of increased dividends, capital gains and stock options, or is part of the $2 trillion cash hoard held by corporations.

Graph: CBPP

For it is the tremendous shift of wealth that has stunted growth since 2000 and caused the Great Recession. Incomes of the wealthiest have soared, mainly because of 2001 and 2003 tax cuts that lowered investment tax rates for the wealthiest and drastically cut tax revenues, while incomes of 99 percent barely grew. This diminished purchasing power of consumers has accounted for most of the $6 trillion in lost output that resulted from the 18-month Great Recession (12/2007 – 6/2009).

It is an example of the failure of small government policies that instead of creating more prosperity for all, diverted it to the wealthiest. And the resulting record income inequality has damaged economic growth say more and more studies, such as a recent IMF study by Andrew Berg and Jonathan D. Ostry that suggests income inequality might shorten our economic expansion by one-third in jobs lost and goods products.

“…a careful look at the varying levels of inequality in different countries demonstrates just how much societal divides in wealth really matter. Countries with high inequality are far more likely to fall into financial crisis and far less likely to sustain economic growth,” said the authors in a Foreign Affairs article.

The U.S. has fallen to the lowest ranking on income inequality. The CIA World Fact Book ranks the U.S. 94th in income equality below all developed countries, Iran, and Russia. In fact, the U.S. is just above Jamaica and the poorest African countries. Wealth—both income and assets—has become concentrated among fewer and fewer Americans, in other words.

In spite of consumers’ massive loss of income, the University of Michigan reports confidence is being restored—though nothing like the 1990s readings of 100 plus. Hence the belief that consumers are becoming resigned to a ‘new’ lower growth normal. The 88.1 reading for current conditions is up a noticeable 2.4 points from September to hint at general growth for October's slate of economic data. The expectations index is up a sizable 5.5 points from September which hints at confidence in income prospects and is a positive for the holiday shopping outlook.

But this new normal for lower growth is nothing like the 1990s, as we’ve said, and as the graph makes clear. Contrary to Mitt Romney’s assertion that governments don’t create jobs, we can now see the effects of FEMA’s disaster relief efforts after Tropical Storm Sandy. Governments spend most revenues in the private sector—whether for defense, education, environmental protection, infrastructure or research.

So we do not have to accept slower growth, if we recognize and right the record inequality that has caused our market economy to repeatedly crash. As Nobel Economist Joseph Stiglitz was quoted in a recent review of his latest book, The Price of Inequality, “Inequality leads to lower growth and less efficiency. Lack of opportunity means that its most valuable asset — its people — is not being fully used. Many at the bottom, or even in the middle, are not living up to their potential, because the rich, needing few public services and worried that a strong government might redistribute income, use their political influence to cut taxes and curtail government spending. This leads to underinvestment in infrastructure, education and technology, impeding the engines of growth… “

Harlan Green © 2012