The Mortgage Corner

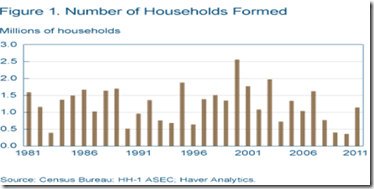

The huge jump is pending home sales could presage a sharp drop in inventory of homes for sale in 2013. Why? There are fewer foreclosures because of the declining shadow inventory of homes in default that have been bloating the for-sale inventories resulting from the housing bubble. And this is already causing home prices to rise while housing construction is still lagging, 50 percent below its recent high.

The Pending Home Sales Index just released by the National Association of Realtors, a forward-looking indicator based on contract signings but not closings, increased 5.2 percent to 104.8 in October from an upwardly revised 99.6 in September and is 13.2 percent above October 2011.

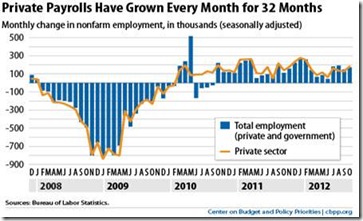

Lawrence Yun , NAR chief economist, said buyers are responding to favorable market conditions. "We've had very good housing affordability conditions for quite some time, but we're seeing more impact now from steady job creation, and rising consumer confidence about home buying now that home prices have clearly turned positive."

Outside of a few spikes during the tax credit period, pending home sales are at the highest level since March 2007 when the index also reached 104.8. On a year-over-year basis, pending home sales have risen for 18 consecutive months.

Graph: Calculated Risk

"The Northeast saw some impact from Hurricane Sandy, but limited inventory in the West is keeping a lid on the market. All regions are up from a year ago, with double-digit gains in every region but the West," Yun said. Housing inventories are down 23 percent in one year.

And we see that foreclosure inventories have been declining, as have foreclosure rates. We now see short sales replacing foreclosure sales, down to just 20 percent of all sales from its high of 35 percent just after the Great Recession.

Calculated Risk reports Lenders Processing Service released their First Look report for October today. LPS reported that the percent of loans delinquent decreased in October compared to September, and declined about 7 percent year-over-year. Also the percent of loans in the foreclosure process declined sharply in October and are the lowest level since August 2009.

Graph: Calculated Risk

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) decreased to 7.03 percent from 7.40 percent in September. Note: the normal rate for delinquencies is around 4.5 percent.

Lastly, home prices are rising because of the declining for-sale inventories. Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio, since housing prices cannot rise faster than rents (i.e., household incomes) over the longer term. Therefore the ratio between rents and prices tells us if housing prices are rising abnormally, as happened during the housing bubble. As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation.

Graph: Calculated Risk

This actually means that we should see a surge in housing construction, and therefore construction jobs in 2013. Stay tuned for the National Association of Home Builders sentiment survey that tracks builder’s confidence in new home construction to confirm that will happen. Its index has already tripled since its post-recession lows.

Harlan Green © 2012