Financial FAQs

Home resales rose in August to their highest rate in more than two years and groundbreaking on new homes also climbed, signs that a budding housing market recovery is gaining traction. The National Association of Realtors said that existing home sales increased 7.8 percent last month to an annual rate of 4.82 million units.

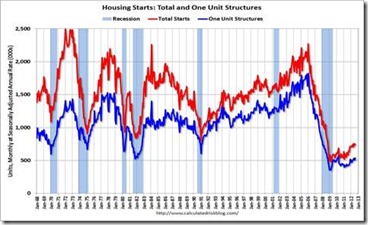

This is while housing starts rose 2.3 percent last month to an annual rate of 750,000 units, the Commerce Department said.

And with 30-year conforming fixed rates now 3.25 percent for less than a 1 point origination fee in California, it looks like the Fed’s QE3 promise of low mortgage rates for as long as it takes will help to speed up the housing recovery.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 7.8 percent to a seasonally adjusted annual rate of 4.82 million in August from 4.47 million in July, and are 9.3 percent higher than the 4.41 million-unit level in August 2011.

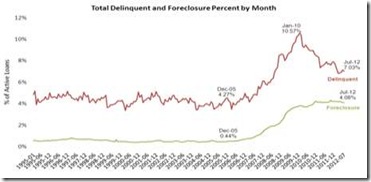

Graph: Inside Debt

And housing inventory decreased 18.2 percent year-over-year in August from August 2011. This is the eighteenth consecutive month with a YoY decrease in inventory, said Calculated Risk, and is boosting housing prices. Months of supply declined to 6.1 months in August.

The national median existing-home price for all housing types was $187,400 in August, up 9.5 percent from a year ago. The last time there were six back-to-back monthly price increases from a year earlier was from December 2005 to May 2006. The August increase was the strongest since January 2006 when the median price rose 10.2 percent from a year earlier.

Nationwide housing production rose 2.3 percent to a seasonally adjusted annual rate of 750,000 units in August, according to newly released figures from HUD and the U.S. Census Bureau. This increase was fueled entirely by gains in the single-family sector, where the pace of new construction rose in every region for a combined 5.5 percent gain to 535,000 units.

Graph: Calculated Risk

“Builders across the country have been reporting noticeable improvement in the number of serious buyers who are in the market for a new home, and today’s report shows that this is translating to some welcome gains in construction activity,” said Barry Rutenberg, chairman of the National Association of Home Builders (NAHB). “While there is still plenty of room for improvement, it’s encouraging to see this continuing trend that is spurring much-needed job growth.” For every 100 new single-family homes that are built, 300 new jobs are created, he noted.

At 535,000 units, single-family housing production hit its fastest seasonally adjusted annual pace in more than two years this August. Meanwhile, multifamily housing production declined 4.9 percent to a seasonally adjusted annual rate of 215,000 units.

Calculated Risk says total starts are up 57 percent from the bottom start rate, and single family starts are up 51 percent from the low. Right now starts are on pace to be up about 25 percent from 2011. Also note that total permits are up sharply from last year. So we can see that single-family construction has to double to reach the longer term 1 million unit mark average since 1962.

We can also see from the Calculated Risk graph that the housing bubble really took off beginning in 1992 and peaked in 2006, so it could be 10 years—2019—before that 1 million unit new-home construction volume is again reached.

Harlan Green © 2012