Popular Economics Weekly

We already have an idea of what will happen in 2015. Firstly, job creation should continue to exceed 300,000 payroll jobs per month. Nobelist Paul Krugman is especially optimistic about economic growth, given that we have escaped much of the austerity budget cuts taken by the Eurozone and Japan.

“What about the prospects looking forward? As I’ve pointed out before, business investment has been relatively strong throughout. Residential investment, however, has been very low since 2006, suggesting that there’s a backlog of pent-up demand, which should come into play in an improving job market. So that’s one source of strength. Also, low oil prices are going to be mostly positive, although with some adverse regional effects; more on that in a later post.”

We would also posit that current economic growth will remain high in 2015, following consecutive 4.6 and 5 percent growth rates in Q2 and Q3. This is because government hiring will continue to pick up as effects of the Great Recession wear off, which has been the main drag on growth, as Professor Krugman says.

"Since Obama took office, we’ve gained 6.7 million private-sector jobs, compared with just 3.1 million at the same point under Bush. But under Bush we’d added 1.2 million public sector jobs, while under Obama we’ve cut 600,000. The point is that relatively good private sector performance has been masked by public-sector cutbacks; this is the opposite of what you usually hear, but that’s no surprise.”

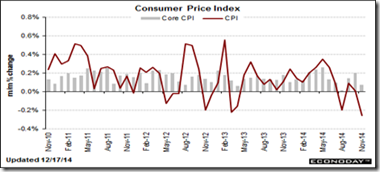

And Fed Chair Janet Yellen is determined to keep interest rates low until wage and salaries climb above the 2 percent inflation rate, which might happen in 2015 with continuing strong job growth.

The weak growth link remains the housing market, and any improvement will be closely watched by economists. The key will be adequate population growth (with more new household formation), especially from the millennials, children of the baby boomers as we have been saying.

Several housing specialists, including the NAR’s Realtor.com, Jed Kolko of Trulia.com, and even Robert Shiller of the Case-Shiller Housing Price Index see a better housing market in 2015. But increased household formation of those millennials that have been living with their parents, or renting, are the key. And 2015 looks to be the year when they begin to buy homes, according to Fortune Magazine’s Fortune.com. Historical household formation has been some 1 million new households per year, but has been less than half the historical average since the end of the housing bubble.

Graph: Fortune

Why? Millennials job growth, for one: “In 2014, it’s been a banner year for employment but parsed by age groups those under 35 have been gaining jobs at a 60 percent faster rate than rest – one of the best years for employment was even better for millennials,” said Realtor.com economist Jonathan Smoke in his recent release of the 2015 housing forecast.

And the oldest cohort of 25-34 puts the majority of millennials out of school and getting married. That’s combined with birth rates putting 2014 in the running for highest volume of births in years, as millennials outnumber their baby boomer parents by as much as 10 percent (as much as 88 million vs. 77 million baby boomers).

We will see what else 2015 brings, of course. More new, entry-level homes will have to be built, of course, so builders have to get the message that millennials won’t be able to afford the homes and higher prices tolerated by their parents.

There are indications that home builders are already doing this. For example, CNBC’s Diana Olick reports homebuilder D.R. Horton has a new brand, Express Homes that offers properties at $120,000 to $150,000 in lower priced states such as Texas and Georgia, well below the national median price of a new home, which in March came in at a record $290,000, according to the U.S. Census.

In other words, if and when housing returns to normal growth levels, we should see more sustained overall economic growth for 2015 and beyond.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen