The Mortgage Corner

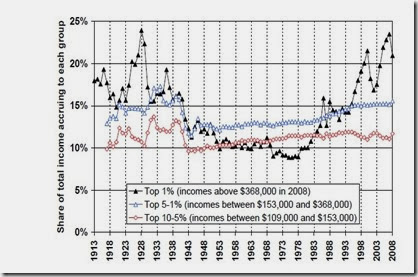

Where is a housing bubble? Some pundits have been saying that housing prices, up some 13 percent in a year, may have been rising too fast. This is mainly because too few homes on the market, and also the pent up demand from 5 years of recession. But the pundits could be wrong about a price bubble. A slowdown in sales is now showing up in the NAR’s Pending Home Sales’ Index that has been declining steadily over the past few months—since last June, basically—and that should slow down the price rises.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, fell 8.7 percent to 92.4 in December from a downwardly revised 101.2 in November, and is 8.8 percent below December 2012 when it was 101.3. The data reflect contracts but not closings, and are at the lowest level since October 2011, when the index was 92.2.

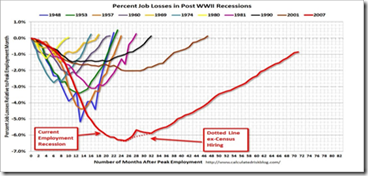

Lawrence Yun, NAR chief economist, said several factors are working against buyers. “Unusually disruptive weather across large stretches of the country in December forced people indoors and prevented some buyers from looking at homes or making offers,” he said. “Home prices rising faster than income is also giving pause to some potential buyers, while at the same time a lack of inventory means insufficient choice. Although it could take several months for us to get a clearer read on market momentum, job growth and pent-up demand are positive factors.”

The disruptive weather wasn’t reflected in personal consumption, up 3.3 percent in the initial 4th Quarter GDP estimated growth of 3.2 percent. So there has to be more at work.

Bill McBride of Calculated Risk listed more possible causes for the decline: “My view is there were several reasons for the decline in this index: weather in some areas, fewer distressed sales, less investor buying, fewer "pending" short sales, and low inventories. I think fewer distressed sales, fewer "pending" short sales, and less investor buying are all signs of a healthier market - even if overall sales decline.”

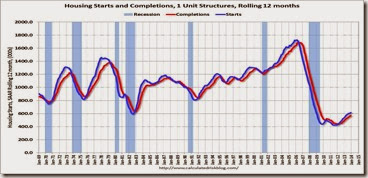

The 3.2 percent Q4 GDP growth was also heartening for 2014 growth prospects. In particular, the share due to real estate investment is growing again after plunging sharply before and during the Great Recession. Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The graph shows that 4-5 percent is the normal range vs. the current 3 percent, and that would mean real estate investment has more room to grow to return to normal levels.

Graph: Calcuated Risk

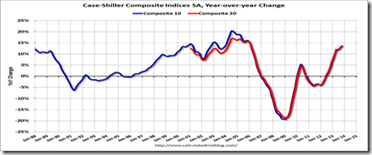

The Great Housing Bubble busted during the Great Recession is probably a once-in-a-lifetime event. Although the late 1980’s Savings & Loan crisis caused prices to fall, overall housing prices recovered quickly because there were no recessions at the time. The so-called Gulf War recession of 1991-92 occurred as housing prices were already recovering.

In fact, 1991 was really the beginning of the Great Housing Bubble that ultimately burst in 2007-08. So we know that housing prices rise and fall with business activity, as well as inflation rates. And we are still at the beginning of this recovery cycle with very low inflation. These are the signs of a “healthier” housing market as distressed sales decline, and we return to a more normal housing mix.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen