Financial FAQs

How does one stop the bullies? Put simply, find a way to stand up to them. Economic bullies behave no differently than individuals when confronted by a person or organization willing to oppose them. But how are the 80 percent that are wage and salary earners to do that whose incomes has been whittled away since the 1970s by anti-union legislation and outright banning of collective bargaining in many of the right to work states?

Popular culture has enshrined the superhuman heroes who have tamed bullies; from Superman and Wonder Woman, to Batman, and now Captain America taming Nazi bullies. But taming economic bullies doesn’t have a popular precedent other than Robin Hood, it seems.

And Robin Hood was an English legend. America can only come up with its opposite, reverse Robin Hoodism, or taking from the poor and giving to the rich. That is how Nobelist Paul Krugman characterizes Republican attempts to cut taxes further and oppose raising the minimum wage.

“In the past, Republicans would justify tax cuts for the rich either by claiming that they would pay for themselves or by claiming that they could make up for lost revenue by cutting wasteful spending. But what we’re seeing now is open, explicit reverse Robin Hoodism: taking from ordinary families and giving to the rich. That is, even as Republicans look for a way to sound more sympathetic and less extreme, their actual policies are taking another sharp right turn.”

So the cards seem to be politically stacked against those who oppose the economic bullies. “(But) It wasn’t always this way,” says Marketwatch’s Rex Nutting. “In the 1950s, 1960s and into the 1970s, trade barriers, strong unions and discrimination gave workers (white male workers, that is) more bargaining power to get higher pay. It created the middle class.”

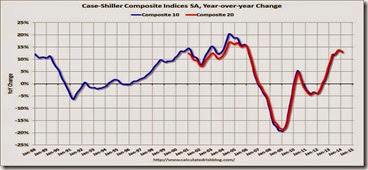

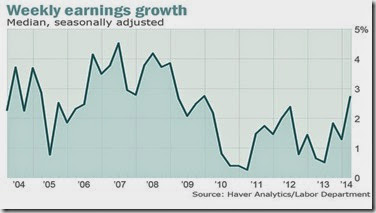

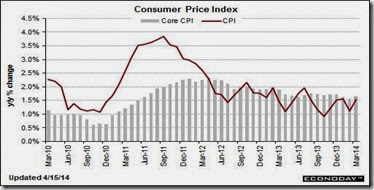

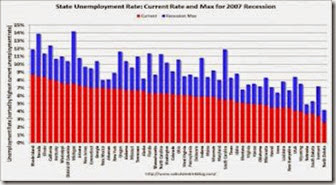

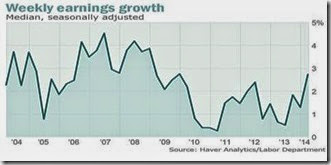

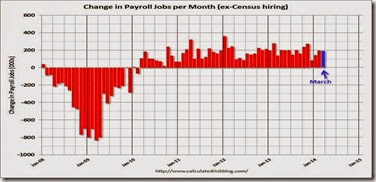

The result of such economic bullyism is that American wages haven’t grown since the 1970s, except for a brief period in the 1990s, when the Federal Reserve allowed the unemployment rate to fall to 4 percent, before beginning to raise interest rates. Thank you, President Clinton (and then Fed Chairman Greenspan during his easy money phase).

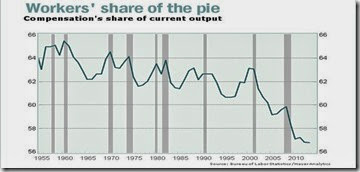

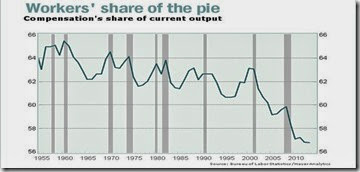

The share of national income that goes to labor (including the CEO’s salary and his stock options) has plunged from about 63 percent to 57 percent, says Nutting. The 6 percent of national income that’s going to profits instead of wages amounts to nearly $900 billion a year.

Graph: WSJMarketwatch

“For corporate businesses, after-tax profits are at record levels as a share of national income,” says Nutting. “Since the recession ended, profits are up 65 percent to $1.68 trillion last year. Small businesses aren’t doing quite so spectacularly, but their income is up 13 percent and their net worth is up 33 percent to $8.7 trillion since the recession ended. And the workers? Even after a big gain in the first quarter, median wages are down 3 percent since the recession ended.”

Many commentators and sociologists in particular assert 9/11 brought modern economic bullying to a high point. It’s rationale was the US put on a semi-permanent war footing, so that “Allegiance to the old public virtues—respect of the Bill of Rights, the Geneva Conventions and the rule of domestic and international law—was mocked and dismissed as quaint and soft by our new drill sergeants, according to a recent Canadian study. “From then on a state of emergency replaced the rule of law and set itself up as the norm.”

On a personal, workplace level, “If we are in a constant war-like mode societally, it sounds trivial, it sounds child-like, it sounds naively utopian to say, ‘Can’t we all get along?’” says Gary Namie of the Workplace Bullying Institute. “If you call for civility or a suspension of unmitigated, unfettered aggression, they call you a wimp. They think you are a wimp.”

There is another term for economic bullies, used by Professor Krugman, among others, in his most recent NYTimes column. They are sadomonetarists, or bankers and economists who want to tighten credit even during such tough economic times, as now: “At some level it has to reflect an instinctive identification with the interests of wealthy creditors as opposed to usually poorer debtors. But it’s also driven, I believe, by the desire of many monetary officials to pose as serious, tough-minded people — and to demonstrate how tough they are by inflicting pain.”

That, of course, is the most cogent definition of a bully. They want to demonstrate how tough they are, regardless of the consequences. For instance, the NAACP recently posted a report by Devin Burghart, Leonard Zeskind and the Institute for Research & Education on Human Rights called “Tea Party Nationalism,” exposing what it calls links between various Tea Party organizations and racist hate groups in the United States, such as white-supremacist groups, anti-immigrant organizations and militias, who have by definition, the bully mentality.

The bully mentality manifests in many forms, besides politically. The gun lobby via the NRA, ALEC, and other organizations have succeeded in blocking government study of the causes of gun violence, even though 31,000 gun-related death occur per year, the highest by a factor of 10 of any country in the world. Needless to say that inhibits development of policies and laws that might lower gun violence, whether in the schools or our inner cities.

So it turns out the bully mentality is part of human nature, really, and so part of our culture. It is then up to those employees who want to better themselves to find a way to oppose that culture and mentality. That means pushing back against the fear that such bullying engenders in all of us—against the ‘boss’ mentality, as well. Remember, such fear has to also be felt by those economists and politicians that allow it.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen