Financial FAQs

The U.S. economy grew at a faster 3.7 percent annual clip in the second quarter, up from the initial estimate of 2.3 percent, the Commerce Department said Thursday. Why was that a surprise to those short sellers afraid of Chinese market contagion, now that the DOW and all stock indexes have soared over the past 2 days?

It’s a repeat performance of the past 2 years. Those severe winters stopped growth in the first quarters of 2014 and 2015, which then snapped back once the Polar Vortex deep freeze melted away. Q1 GDP grew just -0.9 and + 0.6 percent, respectively during those winters. But the Q2s rebounded to 4.6 and 3.7 percent, respectively, once Spring came. So China’s economic ups and downs have had very little effect on U.S. growth.

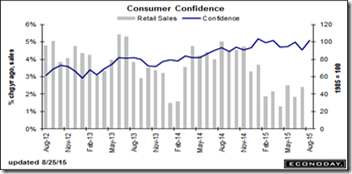

Economists had forecasted gross domestic product would be revised up to 3.3 percent, but business investment was stronger than expected. Business investment helped, but it was consumers, buoyed by low interest rates and inflation boosting their confidence in future jobs and rising incomes that got them spending again. There were no ‘confidence fairies’ worried about budget deficits, in other words.

Consumer spending, always the main engine of U.S. economic activity, led the way. Spending was revised up to 3.1 percent from 2.9 percent in the second quarter after a sluggish 1.8 percent gain in the first three months of the year. No wonder, when eastern and Midwestern shoppers could barely venture from their homes during the deep freeze.

And newly revised figures from the Commerce Department show that businesses invested at a faster rate. Businesses increased investment by 3.2 percent increase instead of a drop of 0.6 percent, with spending on structures such as office buildings rising by 3.1 percent instead of an initial drop of 1.6 percent.

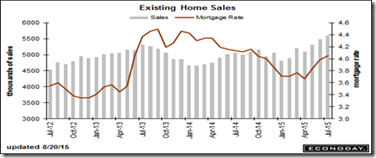

This is huge for real estate, in part due to lower interest rates holding down construction costs. But there was also a large build in retail inventories in anticipation of back to school and holiday shoppers. The value of inventories, which adds to GDP, increased by $121.1 billion in the second quarter instead of a previously estimated $110.0 billion.

In fact, it was real (after inflation) final sales to private domestic purchasers up 3.3 percent, a measure of activity without inventories, that did the most to boost GDP growth.

The bottom line is that consumer confidence is soaring to new heights, as we said yesterday. An enormous improvement in the current labor market (e.g., rock bottom initial unemployment claims) drove the consumer confidence index well beyond expectations, to 101.5 in August for a more than 10 point surge from July. A rare 6.5 percentage point drop to 21.9 percent in those describing jobs as currently hard to get points to outsized gains for the August employment report.

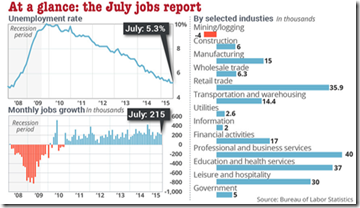

Why is this a surprise? With the unemployment rate down to 5.3 percent, and more than 8 million jobs created since 2008, maybe consumers are finally convinced the U.S. economic growth is for real. The gain for this confidence reading lifts the present situation component, a near term confidence reading, to 115.1 for a more than 11 point increase over July that points to consumer power for August (and maybe September, October, then into the holidays).

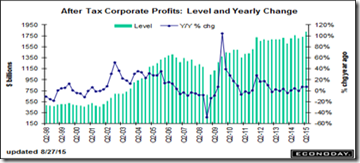

With consumer spending soaring, corporate profits continue to surge, hence the increase in business investment. Just reported profits in the second quarter came in at $1.824 trillion, up a year-on-year 7.3 percent.

So let’s not forget that gas prices are closing in on $2 per gallon in many parts of the country, which holds down inflation, which in turn boosts incomes. So consumers are beginning to show they are the real beneficiaries of lower oil-energy prices, no inflation pressures, and rising incomes.

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen