Popular Economics Weekly

US consumers are feeling good, with higher confidence and rising wages pushing demand for housing and consumer spending. The Conference Board’s Consumer Confidence Index rose a huge 4.4 points to 101.3 in August. It has been hovering in this range for more than one year, reflecting the strong jobs market.

“Consumer confidence improved in August to its highest level in nearly a year, after a marginal decline in July,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of both current business and labor market conditions was considerably more favorable than last month. Short-term expectations regarding business and employment conditions, as well as personal income prospects, also improved, suggesting the possibility of a moderate pick-up in growth in the coming months.”And consumer spending is reflecting that optimism. Consumer spending last month was lifted by a 1.6 percent surge in purchases of long-lasting manufactured goods such as automobiles. Spending on services rose 0.4 percent, but outlays on non-durable goods slipped 0.5 percent (such as food and clothing).

Who can blame consumers for being cautious? But with housing markets taking off, it looks at long last that housing supplies are returning to normal. The Case-Shiller Home Price Index is now rising a more normal 5 percent per year, down from its recent 10 percent rise in 2013-14, as more housing comes on the market.

In boom cities like Portland and Seattle prices rose 12.6 and 11 percent, respectively, while Denver and Dallas were some 9 percent higher in June. Cities that suffered the most from the bust are also recovering in such areas as California’s Central Valley and San Francisco’s East Bay; cities such as Stockton and Vallejo that filed for bankruptcy because of the housing bust.

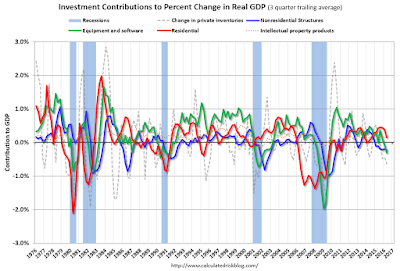

So what has been keeping economic growth in the 1 percent range of late, over the last 3 quarters? Most of it comes from a slowdown in labor productivity due to businesses’ refusal to invest in capital improvements. Labor productivity is at a historic post WWII low, increasing just 1.3 percent since the Great Recession, as I said last week. Normally, so-called cap-ex spending should also surge after such a downturn for production to catch up with depleted inventories, but it hasn’t this time.

Instead, corporations have been using their record profits to buy back stock, enhancing their own and stockholders incomes, a major cause also for the record income inequality. That has to change, needless to say, if voters have anything to say in the upcoming elections.

Harlan Green © 2016

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen