We have a looming Cold War with Russia due to its invasion of the Ukraine, as well as inflation to worry about this year. What will it do to economic growth and jobs?

Inflation won’t recede soon with soaring oil prices, but higher economic growth is in the cards for the New Year. The Fed’s favorite indicator of consumption, the Personal Consumption Expenditure price index (PCE) gained 6.1 percent year-over-year in January, the largest gain since 1982, and consumer spending in January rose 2.1 percent month-over-month, better than the expected forecast of 1.5%.

“At least for now, consumers aren’t pulling back much on their spending in light of high inflation,” said one commentator.

Other indicators of growth aren’t slowing, either, according to the flash IHS Markit flash surveys of the manufacturing and service sectors. Both surveys have risen to the mid-50s, a strong sign of future growth in both sectors.

And Q4 GDP growth was revised slightly higher in its second estimate to 7 percent, the highest growth rate in 40 years. Job creation will also continue to grow as the Omicron variant recedes.

There is more good news on jobs. Initial jobless benefit claims fell by 17,000 to 232,000 in the week ended Feb. 19, the Labor Department said Thursday. The number of people already collecting jobless benefits fell by 112,000 to 1.48 million in the week ended Feb. 12. These so-called continuing claims are at their lowest level since March 1970, which means new job creation exceeds those being laid off or quitting.

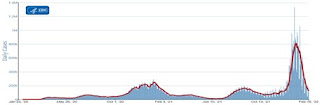

The main issue is what all this does to continuing job growth, with the Omicron variant infections returning to pre-Omicron levels. The CDC news is also good on that front.

CDC.com

The CDC said, “as of February 16, 2022, the current 7-day moving average of daily new cases (121,665) decreased 43.0% compared with the previous 7-day moving average (213,625). A total of 78,060,327 COVID-19 cases have been reported in the United States as of February 16, 2022.

The elephant in the room that could cancel the good news is effects from the invasion of the Ukraine, of course, especially sanctions that might prolong the high inflation numbers.

Excluding volatile gas and vehicle sales, the PCE price index quoted above rose 5.2 percent, and consumers in the latest University of Michigan sentiment survey don’t see prolonged inflation.

So with the Omicron variant receding, the duration of higher inflation will depend on what is happening in the Ukraine. That will be hard to predict with a Russian dictator who seems to have lost touch with reality. Does he really want to start another Cold War with the Western world united against him?

I don't think so.

Harlan Green © 2022

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen