President Biden said it best concerning the agreement to raise the national debt ceiling for two years, when asked at the G-7 summit if it could cause a recession.

“I know it won’t…Matter of fact, the fact that we were able to cut government spending by $1.7 trillion, that didn’t cause a recession. That caused growth.”

What did he mean?

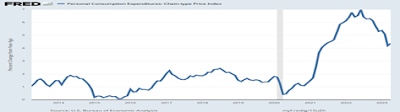

Federal spending had already been reduced by $1.7 trillion last year with expiration of much of the COVID-19 spending programs. The above FRED graph shows it also reduced the federal debt-to-GDP ratio from 135 percent in Q1 2020 to 119 percent in Q1 2023, a cut of 16 percent.

One of its selling points was that the new debt ceiling and 2023-24 fiscal year budget agreement would continue reducing the deficit as well as growing the economy.

The agreement will continue government programs such as the Inflation Reduction Act and Infrastructure Investment and Jobs Act that are part of the New New Deal, a bevy of government programs generated to recover from the COVID pandemic and modernize the US economy, just as happened in the 1930s with Roosevelt’s New Deal.

The New York Times estimated the agreement should cut some $136 billion in government spending over the next two years by limiting the growth of discretionary spending on such as Food Stamps and early childhood education, part of the Republican wish list.

The G-7 summit President Biden just attended also signaled greater agreement of western nations in supporting a worldwide economic recovery that will aid the US economy as well.

The coordination of G-7 countries in military spending as well as the mitigation of global warming could generate a new industrial age in the words of recent Barron’s columnist and former Senior Treasury official Christopher Smart I cited in a recent column that could “launch a golden age of industrial policy.”

He estimates that the Biden administration will mobilize a stunning $3.5 trillion in public and private money over the next decade that could spur a ‘Roaring 2020s’ (my term) over the rest of this decade.

There are those that continue to believe in a looming recession, but that can only happen if the Fed continues to raise interest rates while enforcing its 2 percent inflation target. The Conference Board’s consumer confidence survey showed higher pessimism among consumers, though it hasn’t stopped their spending in leisure and entertainment activities.

“Consumer confidence declined in May as consumers’ view of current conditions became somewhat less upbeat while their expectations remained gloomy,” said Ataman Ozyildirim, Senior Director, Economics at The Conference Board. “Their assessment of current employment conditions saw the most significant deterioration, with the proportion of consumers reporting jobs are ‘plentiful’ falling 4 ppts from 47.5 percent in April to 43.5 percent in May. Consumers also became more downbeat about future business conditions, weighing on the expectations index.”

Let us hope the Fed sees some light at the end of its struggle to tame inflation. More data is confirming that the inflation rate will continue to subside, regardless of the Fed’s actions.

It really looks like America will have partners to aid it in this economic recovery. There should be enough available resources to grow a new, New Deal.

Harlan Green © 2023

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen