Financial FAQs

Historical hindsight is always 20-20, but why didn’t economists and the Fed act sooner to deflate the housing bubble? By waiting until 2006 to tighten credit, the Federal Reserve allowed overbuilding of the housing sector that resulted in the current oversupply of some 1 million homes.

Housing bubbles can be detected and treated if Fed officials and others had heeded their own research. One measure they looked at was the housing rent-to-price ratio, or ratio of housing rents to prices. When prices rise much higher in relation to rents, then we know those rises are not sustainable, but speculative.

The Federal Reserve was worried about a housing bubble as far back as 2004, according to Calculated Risk. But nothing was done about it under Alan Greenspan’s chairmanship. We now know why. Greenspan didn’t believe housing prices could rise to bubble heights. He maintained housing wasn’t as ‘liquid’ as other investments, and so subject to the same speculation as stock and bond values that created the dot-com bubble. But such proved not to be true when the Fed changed its monetary policy that brought in the low interest rates and easy credit lasting from 2004 to 2007.

The Fed was looking at a ratio calculated by one of its researchers that saw rents had plunged to less than 2 percent of housing prices in 2004, due to soaring home prices. “I don’t want to leave the impression that we think there’s a huge housing bubble,” said the Fed’s associate director of research. “We believe a lot of the rise in house prices is rooted in fundamentals. But even after you account for the fundamentals, there’s a part of the increase that is hard to explain”.

Even though economists such as Robert Shiller saw the housing bubble, as we reported last week. He told the Fed in 2005 that housing prices could plunge as much as 50 percent in some regions. And that has happened in cities like Las Vegas and Phoenix, with Detroit, Miami and Tampa, Florida not far behind.

Homeownership rates have also plunged from 69 to 67 percent of households, according to the U.S. Census Bureau, as more households return renting. Could the exodus of homeowners to renting turn into a flood? The homeownership rate was as low as 64 percent in 2004, and the historical average seems to hover around 65 percent. Is that the actual percentage of households who can truly afford to own? Time will tell.

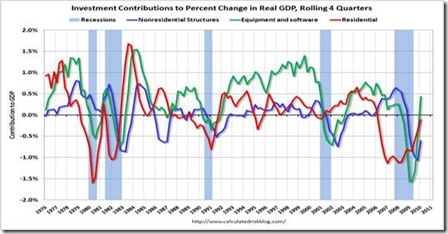

First quarter GDP growth was 3.2 percent, the third consecutive quarter of economic growth. Both residential and non-residential investment are still a drag on growth with equipment and software pulling us out of the recession. But it looks like housing construction (i.e., residential investment) is poised to become a positive factor. Note that the recession probably ended in mid-2009, according to Calculated Risk.

The consumer sector is helping the recovery gain traction. Not only did income improve but spending accelerated. Personal income strengthened in March, gaining 0.3 percent, following a 0.1 percent rise the prior month. The heavily-weighted wages & salaries component increased 0.2 percent in March after edging up 0.1 percent in February.

Consumer spending rose at a faster pace due to a jump in motor vehicle sales. Overall, personal consumption posted a 0.6 percent boost in March, following a 0.5 percent jump the month before. The March figure equaled expectations but February spending was revised up from a 0.3 percent initial estimate. By components, durables spiked 3.6 percent in March, nondurables advanced 0.3 percent, and services rose 0.2 percent.

Personal income growth for March rose to 3.0 percent over last year, rising from 2.2 percent in February. Year-ago headline Personal Consumption Expenditure inflation firmed to 2.0 percent from 1.8 percent in February, nearing the upper limit of the Fed’s inflation target. The so-called core PCE inflation without energy and food prices was steady at 1.3 percent.

The Fed was caught up in the ‘group think’ of that time, which said that freeing markets to run their own course was the path to prosperity. Greenspan, et. al., wanted to foster faster economic growth without heeding the warning signs, in other words.

It turns out that asset bubbles can be detected, and surprise, surprise, ideology cannot trump reality, as much as Greenspan’s Federal Reserve attempted to mold the debate. We also see that the rent-to-price ratio has returned to historical levels, more evidence that housing prices have finally stabilized.

Harlan Green © 2010

No comments:

Post a Comment