As stock and bond investors cringe and run to their rabbit holes on news that European, or even Chinese economic growth may slow, the American consumer doesn’t seem as concerned. Domestic consumer incomes and spending look better in May.

The consumer sector got another boost with a jump in spending power. Personal income in May rose a solid 0.4 percent, following a 0.5 percent advance in April. Analysts had called for a 0.5 percent increase in personal income for the latest month. The key wages & salaries component gained 0.5 percent, matching April's improvement.

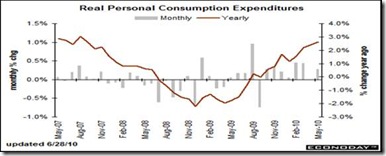

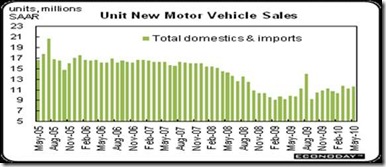

Overall, personal consumption rose a modest 0.2 percent, following no change in April. A jump in auto sales helped offset softness in gasoline and other subcomponents in nondurables, as we said last week. By components, PCEs were led by a 0.8 percent boost in durables-reflecting motor vehicle sales. But services also were robust with a 0.5 percent jump.

Motor vehicles sales spiked to 14.1 million units annualized in August 2009 but plunged to 9.2 million units in September after special incentives ended. But the good news was that sales returned to trend in just a few months with 11 million unit sales in May. This was based on a stabilized consumer sector and credit that was not so difficult to get. Non-revolving credit, reflecting strong car sales, jumped $9.4 billion in April, according to the Federal Reserve.

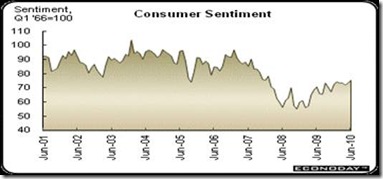

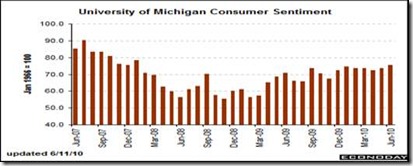

Though consumer confidence is still shaky with conflicting U. of Michigan and Conference Board sentiment surveys, the Case-Shiller Home Price Index showed the first increase in home prices in 6 months. The unadjusted composite 10 index broke a long series of declines with a 0.7 percent surge, a surge that's less dramatic when seasonally adjusted but still very good at plus 0.3 percent. The year-over-year rate, a comparison less exposed to seasonal variation than the month-to-month comparison, is at plus 4.6 percent on the unadjusted side and at plus 4.7 percent when adjusted, up 1-1/2 percentage points from March on both scores. Details show broad gains across nearly all cities.

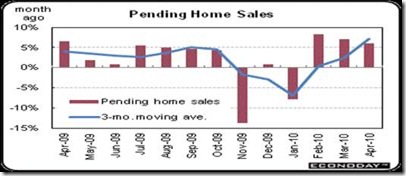

The results are consistent with the existing home sales report that likewise showed large price gains in April followed by even larger gains in May, though sales are still flat.

Existing home sales fell 2.2 percent to an annual sales rate of 5.66 million from April’s 5.79 million. The recent peak in existing home sales was 6.49 million units for November 2009 when the original tax incentives expired. The more recent bump in sales from the second round topped at April’s 5.79 million units. High supply will continue to pressure prices which did, however, firm 4.2 percent in May for both the median price ($179,600) and average price ($226,400). The price gains likely were related to a shift in composition to more expensive homes.

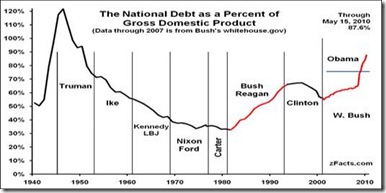

What does this mean? That consumers continue to be cautious spenders, largely because of the current deflationary environment, which means they are counting on prices to fall further. This is a sign that is worrying Nobel economist Paul Krugman, for one. He has been lamenting the current G20 consensus that paying down debts is more important than further stimulus spending.

In other words, consumers pull back when prices are falling, which further damages economic growth. So there is no danger of inflation, which is the fear deficit hawks foster to justify the pain they want to inflict on the real estate market in particular.

Overall, the consumer sector is slowly gaining strength in terms of spending power. Purchases have been a little erratic due to off and on auto incentives and consumer caution in general. But the consumer sector took one step forward in May, helping the recovery continue.

Harlan Green © 2010