How interdependent we have become! The lessons of this recession and the ongoing recovery, is that going it alone won’t work—whether when drilling oil wells, or evading financial regulations. We even have to thank our dependence on foreign trade with Asia, and our government-aided auto industry, for what is leading this recovery—the manufacturing sector.

Economic interdependence is becoming the norm in this decade—private industry (via innovation) and governments (via regulation) are becoming more interdependent. One can no longer exist without the other. And what affects one sector now affects the overall economy.

The bursting housing bubble almost caused the worldwide collapse of the financial system because financial markets are now interconnected. The BP Gulf oil disaster is an example of nature’s interconnectedness. A toxic spill has become toxic to all states in the Gulf region.

Overall industrial production in May surged 1.2 percent, following a 0.7 percent boost the month before. The latest number was stronger than the consensus forecast for 1.0 percent. Manufacturing has been robust over the last three months with this component gaining 0.9 percent in the two latest months and jumping 1.2 percent in March.

A jump in motor vehicle production also added significantly to May's overall production boost. Motor vehicle production jumped 5.5 percent, following a 1.4 percent dip in April. Nonetheless, gains were widespread in other industries, with business equipment up 1.3 percent, and consumer goods up 1.2 percent. Industrial production improved to 7.6 percent from 5.2 percent in April on a year-over-year basis.

The housing bubble has been a leading lesson in the recognition that housing is closely connected with other sectors; such as insurance, construction and finance.

And the construction industry is beginning to recover, a good sign for real estate. Expiring special tax credits for homebuyers and the recent surge in home sales have carried over to unexpected strength in construction activity. Apparently, this has cut into new home inventories enough to give homebuilders confidence to bump up the pace of new construction. However, gains are coming off low levels.

Construction outlays in April surged 2.7 percent, following a 0.4 percent rebound the month before, and rose to minus 10.5 percent in April from minus 12.5 percent in March, year-over-year. The April boost was led by a jump in private residential outlays which gained 4.4 percent after no change the prior month. Public outlays increased 2.4 percent in the latest month while private nonresidential construction rebounded 1.7 percent.

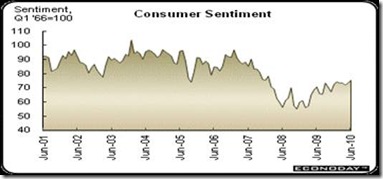

Lastly, and not so obvious, was the housing bubble’s effect on consumer confidence. It was probably a cascade effect—housing burst, then credit, which stopped both consumers and investors from borrowing. This resulted in the greatest credit contraction since WWII and the Great Depression that has now lasted 20 months.

Consumers appear to be focusing specifically on the health of the U.S. economy—shrugging off sovereign debt worries in Europe and the recent drop in stocks. The Reuters/University of Michigan Consumer Sentiment Index rose to 75.5 in the mid-June reading versus 73.6 for the final reading of May. The nearly two-point gain was sizable and put the index at its best level since the January 2008 figure of 78.4.

There is a pent-up demand for housing. The Harvard Joint Housing study estimates 15 million new households will be formed in this decade 2010-2020. But there is uncertainty whether more will rent than own. Home ownership could also be a casualty of the housing bust, in other words. But that won’t hurt construction, as the latest housing starts numbers showed a big jump in rental construction (33 percent) vs. a 10 percent drop in single family housing starts.

Harlan Green © 2010

No comments:

Post a Comment