The NAR’s Pending Home Sale Index, a forward-looking indicator of existing-home sales, rose 4.3 percent to 82.3 based on contracts signed in August from 78.9 in July. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.

The NAR’s chief economist Lawrence Yun said the latest data is consistent with a gradual improvement in home sales in upcoming months. “Attractive affordability conditions from very low mortgage interest rates appear to be bringing buyers back to the market,” he said. “However, the pace of a home sales recovery still depends more on job creation and an accompanying rise in consumer confidence.”

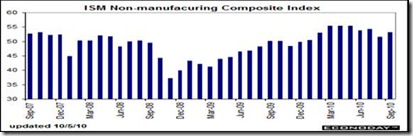

Job creation was helped by the latest Institute of Supply Management’s service sector index, which showed month-to-month strength in September, an important indication for second-half economic growth. The ISM's non-manufacturing composite rose more than 1-1/2 points to 53.2, right in line with the year's trend which is 53.6. New orders had been slowing but picked up nicely, 2-1/2 points to 54.9.

The employment index in particular picked up 2 points as did supplier deliveries, while both new export and import orders soared, with export orders up a whopping 12 points in the index. A significant slowing in delivery times is a definitive sign of strength in this report, at 55.0 for the highest reading in more than two years. The non-manufacturing sector shows plenty of activity, in other words, news that should boost September’s employment report.

Another boost could come from consumers. Despite sluggish job growth, the combination of modest growth in average hourly earnings, private employment, and steady or firming weekly hours is gradually boosting wages and salaries—at least in the private sector. Personal income in August advanced a healthy 0.5 percent, as we said last week, following a 0.2 percent rise the month before and beating the market estimate for a 0.3 percent rise.

Does the increase in pending home sales mean prices will stabilize? The S&P Case-Shiller (same) Home Price Index was still positive, but not as positive as in the spring, before the April expiration of the homebuyers’ tax credit.

The unadjusted data show strength, up 0.8 percent for the composite 10 for a fourth straight solid gain. But seasonal patterns play a big role in home prices and summer is a seasonally a busy time for the market with higher demand providing some lift for unadjusted prices.

The Pending Home Sale Index declined 2.9 percent in the Northeast to 60.6 in August, while it rose in all other regions. It rose 2.1 percent in the Midwest increased 6.7 percent in the South to an index of 90, and rose 6.4 percent in the West.

Will an improving economy boost employment? The signs are there, with falling labor productivity in Q2 indicating the existing workforce cannot produce more, and real estate showing a bit of life, in spite of the foreclosure backlog. It really looks like RE prices have bottomed out—in fact have been stuck in a range for more than one year—since May 2009, according to Case-Shiller.

So there is no reason for homebuyers to put off buying. It looks like employers are at least willing to boost the incomes and benefits of those 90 percent who are employed, in return for their longer hours.

Harlan Green © 2010

No comments:

Post a Comment