Popular Economics Weekly

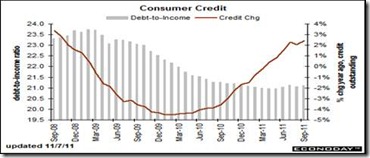

The elements seem to be in place for a better 2012 economy, despite the euro worries, budget deficits, and 8.6 percent jobless rate. Why? Banks are lending again, and it was the tight bank credit after bursting of the housing bubble that basically stopped businesses from growing. Banks stopped lending because of their losses from the Great Recession, which finally ended in June 2009.

After three years of Scrooge-like underwriting following 2008's financial crisis, banks have turned on the spigot, boosting lending at annual rates as high as 8.2 percent since July, according to Federal Reserve statistics.

Lending had fallen from mid-2008 through this year's second quarter, deepening what became the worst recession since the Great Depression. The data seem to allay fears that making banks keep more capital on their books as a cushion against future downturns and loan losses will take away the cash flow businesses need to keep the recovery moving.

Even small businesses have seen a difference, says Bill Dunkelberg, chief economist of the National Federation of Independent Business. In a monthly NFIB survey, only 3 percent of small-business owners say lack of credit is their most important problem, trailing taxes, regulation and still-sluggish demand, and small business accounts.

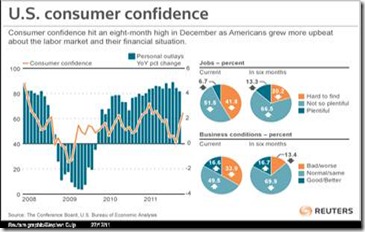

Then the Conference Board’s Index of Leading Economic Indicators continues to show 3 percent plus GDP growth for the next 6 months.

Graph: Wrightson ICAP

The LEI is a weighted gauge of 10 indicators designed to signal business cycle peaks and troughs. Among the 10 indicators that make up the LEI, seven made positive contributions in November. The index rose a very solid 0.5 percent following October's 0.9 percent surge. The leading positive is the rate spread which reflects the Federal Reserve's zero interest rate policy, said its press release. The second positive is building permits which appear to be building steam in what is very good news for the construction sector.

Consumer expectations are also a big positive in the month and judging from this month’s consumer sentiment report look to be a big positive for December. Another positive that's likely to extend through this month is the November improvement in jobless claims which gave the fifth strongest contribution to the month's 0.5 percent gain.

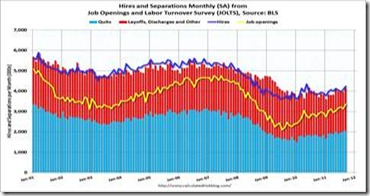

The sharp decline in weekly initial unemployment insurance jobless claims means fewer workers are being fired. Layoffs are on a steady decline in what is good news for the jobs market and for the December employment report. Initial claims fell for a third week in a row, down 4,000 to a much lower-than-expected level of 364,000 (prior week revised to 368,000 for a 17,000 decline). The four-week average is also down for a third week in a row and down for six of the last seven, declining 8,000 to 380,250 which is the lowest level of the recovery.

Graph: Econoday

Both the University of Michigan and Conference Board sentiment surveys continue to improve. The U. of Michigan reading implies a very strong 72.1 over the last two weeks which points to momentum for January. The bulk of the gain is centered in expectations, at 63.6 in December for a more than eight point monthly gain that points further to momentum in the New Year. The assessment of current conditions, likely held down by bad news out of Europe, rose only two points in the month to 79.6.

Graph: Inside Debt

The New York-based Conference Board said that its December Consumer Confidence Index rose almost 10 points to 64.5, up from 55.2 in November. The surge builds on another big increase in November, when the index rose almost 15 points from the month before.

One likely positive for sentiment is improvement in the jobs market as well as the stock market which has been on the recovery, said Econoday. Another positive may be gasoline prices which, despite $100 oil, are on the decline. One-year inflation expectations eased one tenth in the month to 3.1 percent with five-year expectations unchanged at 2.7 percent.

Small businesses are important because they account for 70 percent of new jobs. Though slack demand is still making entrepreneurs wary of borrowing, says NFIB chief economist William Dunkelberg: Only 12 percent think business will be better in 12 months than it is now. “Two-thirds of business owners say, “Who wants a loan?” says Dunkelberg, who is chairman of a small Pennsylvania bank. “In thirty years, I’ve never seen anything like it. The banks all have money to lend, but there’s a shortage of eligible customers coming in.”

Small businesses are the key, so we know the recovery will become sustainable if they can continue to borrow. Increased bank lending is a sign of increased demand for products and services in 2012, a good sign for all businesses.

Harlan Green © 2011