Popular Economics Weekly

Not only were the employment numbers for the past 3 months much higher than originally estimated, but job openings are growing. All we need now is for consumers’ credit conditions to ease to bring back their confidence.

Much of the pessimism and predictions of a second recession were based on faulty data, and that has caused lenders to pull back. For instance, instead of 0 job growth in August that scared the markets, more than 104,000 jobs were created after ‘revisions’ to the seasonal adjustments that we have discussed in past columns. In fact, payroll jobs in October posted a gain of 80,000 after rising a revised 158,000 in September (originally 103,000). So revisions for August and September were up net 102,000.

In fact, consumers are spending for the holidays as if the Great Recession is finally over, in spite of still uncertain income and credit conditions. The caveat: It took 23 months for consumption per person to return to its pre-recession level in earlier recessions. At 42 months, personal consumption has not yet returned to 2007 pre-recession levels, though some of that consumption was fueled by the housing bubble and may not be desirable, says Kevin Lansing of the San Francisco Federal Reserve.

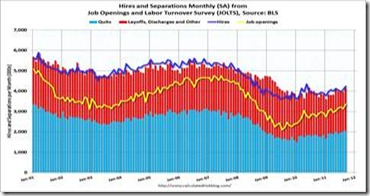

Graph: Calculated Risk

Firstly, the number of job openings in September was 3.4 million, up from 3.1 million in August. Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the level in September was 1.2 million higher than in July 2009 (the most recent trough for the series). The number of job openings has increased 38 percent since the end of the recession in June 2009, which tells us growth is picking up. We should therefore see 3 percent plus GDP growth for the rest of this year, at least, contrary to the Federal Reserve’s downwardly revised forecasts.

The consensus expected unemployment to be stuck at 9.1 percent instead of dropping to 9 percent in the Labor Department’s October household report, which tracks self-employeds as well. The unemployment rate declined largely on a sizeable 277,000 boost in household employment which has posted significant increases for three months in a row. The increases in August and September were 331,000 and 398,000, respectively.

And there is additional favorable news in the household survey. Part-time employment for economic reasons is down and the duration of unemployment declined in October. In nonagricultural industries, the number of those employed part time instead of full time for economic reasons dropped 328,000, says Econoday.

By downgrading its growth estimates, the Fed is leaving the door open for additional ease with the emphasis on significant downside risks remaining. For real GDP, the central tendency forecast for 2011 is now a 1.6 to 1.7 percent versus the prior range of 2.7 to 2.9 percent. The large downgrade likely is due to a large downside miss to second quarter growth. (But we believe growth will also be upgraded in coming months.) For 2012, forecast growth is 2.5 to 2.9 percent versus June’s 3.3 to 3.7 percent. For 2013, forecast growth is 3.0 to 3.5 percent versus June’s 3.5 to 4.2 percent. The Fed doesn’t see sustained growth until 2014—a range of 3.0 percent to 3.9 percent.

And early data for October on actual purchases by consumers indicate that this sector is doing better than suggested by surveys on the consumer mood, as we said. Thanks to the one area where credit is easing, unit new motor vehicle sales rose 1.2 percent in October after surging 8.0 percent the month before. October’s sales pace was 13.3 million units annualized, compared to 13.1 million in September.

The bottom line is that credit is still being tightened in most areas, according to the Federal Reserve’s October 2011 Senior Loan Officer Opinion Survey on Bank Lending Practices. Fewer domestic banks eased standards and terms on commercial and industrial (C&I) loans over the third quarter compared with recent quarters, particularly on loans to large and middle-market firms, said the survey. And all of the domestic and foreign respondents that reported having tightened standards or terms on C&I loans cited a less favorable or more uncertain economic outlook as a reason for the tightening.

And so consumers will have to be patient, if they want to see credit standards easing for such as home loans. We hope the HARP II loan modification program that allows lowered payments and shortened payoff terms Fannie Mae and Freddie Mac-owned mortgages, though no principal reduction, will spur refinances and thus many to move out of their homes to find new jobs to be helpful.

The bottom line is that consumers are borrowing again, but for longer term purchases and still reducing their credit card debt, in part because banks are still restricting credit card use. Consumer credit expanded $7.4 billion in September benefiting once again from strength in nonrevolving credit, said the Federal Reserve’s latest Consumer Credit report. So-called installment loans outstanding, reflecting strong vehicle sales, rose $8.0 billion in the month to $1.66 trillion. This offsets another contraction in revolving credit, down $0.6 billion to $789.6 billion outstanding.

Harlan Green © 2011

No comments:

Post a Comment