Real estate will recover if jobs recover, and jobs will recover if GDP growth is 4 percent in 2011 as some economists are predicting with the lame duck Congress stimulus bill just passed. Growth has been subpar since June 2009, the end of the recession. But with consumers’ personal consumption rising, the latest tax cuts that go to the payroll tax as well as small businesses might boost employers’ confidence enough to push GDP growth past its current 3.2 percent annual average.

The real news was the 103,000 additional nonfarm payroll jobs created in December—113,000 on private payrolls less the net loss of 10,000 government jobs. And prior months were revised upward, so that 1.1 million total jobs were created in 2010, and more than 7 million remain unemployed.

We are therefore seeing a very flat-bottomed W-shaped recovery, which is why Ben Bernanke is predicting it will take “years” for a return to normal employment. The unemployment rate dropped to 9.4 from 9.8 percent, only because as many dropped out (-260,000) of the workforce as found new jobs (+297,000).

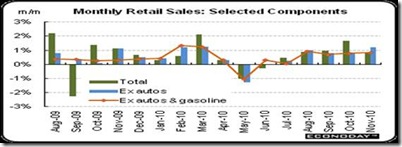

Real GDP growth has been subpar, as we discussed in last week’s column (“Which Deficit is Most Important?”), mainly because of weak demand from consumers. But soaring retail sales will cause increased production on both the industrial and service sector economies.

Chain store sales in December came in lower than expected at +2.8 percent based on BTMU's tally of about 30 retail chains representing nearly $55 billion in total sales. But combined November/December same-store sales are up +3.8 percent, same as overall retail sales reported by the Commerce Dept.—the best sales since +4.4 percent in 2006. It is the middle and lower income brackets that have suffered most from this recession. Luxury retailers are on fire, said Econoday.

Exports will continue to lead the way, as the composite index from the ISM manufacturing survey for November came in at 56.6-well above breakeven and just below October's 56.9 reading. The pace of production slowed noticeably but, at 55.0, is still strong though less strong than the prior month's 62.7. We are likely to see a moderately healthy headline number for December as the new orders index remains on a recent rebound, posting at 56.6 in November, indicating solid month-to-month growth.

What about real estate, the laggard in this recovery? “If we add 2 million jobs as expected in 2011, and mortgage rates rise only moderately, we should see existing-home sales rise to a higher, sustainable volume,” NAR chief economist Lawrence Yun said. “Credit remains tight, but if lenders return to more normal, safe underwriting standards for creditworthy buyers, there would be a bigger boost to the housing market and spillover benefits for the broader economy.”

The key will be a further drop in foreclosures that has bloated housing inventories, and prevented new-home construction from reviving. The current 60-day plus delinquency rate is more than 9 percent, while the foreclosure rate is 4.25 percent. The decline in delinquencies/foreclosures began in January 2010, at the same time as employment began to increase. So we see a drastic drop in foreclosures if the jobs market continues to improve in 2011.

Harlan Green © 2011

No comments:

Post a Comment