The Mortgage Corner

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 2.7 percent to a seasonally adjusted annual rate of 5.36 million in January, 5.3 percent above the 5.09 million level in January 2010. This is the first time in seven months that sales activity was higher than a year earlier, and is a sign that buyers are gaining confidence in the economic recovery.

It is while sales of newly built, single-family homes declined 12.6 percent to a seasonally adjusted, annual rate of 284,000 units in January, according to the U.S. Commerce Department. But that is because of record low housing construction. The inventory of new homes for sale continued to edge downward by 0.5 percent to 188,000 units in January due to the lack of inventory, which amounts to a 7.9-month supply at the current sales pace.

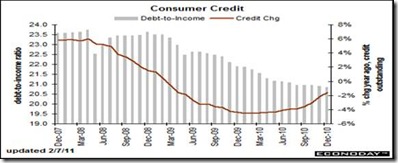

It is obvious that the oversupply of existing homes on the market has caused a precipitous drop in new home construction, whereas until 2006 they rose and fell in tandem. NAR chief economist Lawrence Yun said the improvement is good but could be better. “The uptrend in home sales is consistent with improvements in the economy and jobs, which are helping boost consumer confidence,” Yun said. “The extremely favorable housing affordability conditions are a big factor, but buyers have been constrained by unnecessarily tight credit. As a result, there are abnormally high levels of all-cash purchases, along with rising investor activity.”

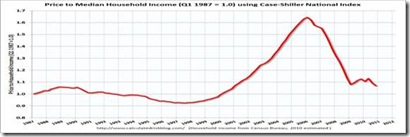

We can see that affordability has improved drastically when looking at the ratio of housing prices to household median incomes. When the ratio rises, it is a sign of inflated housing prices. So such a ratio is a good measure of fundamental values, because household incomes cannot fluctuate wildly, whereas home prices depend much more on the availability of credit. Therefore the price to income ratio measures how much prices might be outside the most affordable range of household incomes. The ratio is currently hovering around 1.0:1.1 (prices to household income), vs. the 1:1 long term ratio.

A parallel NAR practitioner survey shows first-time buyers purchased 29 percent of homes in January, down from 33 percent in December and 40 percent in January 2010 when an extended tax credit was in place. Investors accounted for 23 percent of purchases in January, up from 20 percent in December and 17 percent in January 2010. The balance of sales were to repeat buyers. All-cash sales rose to 32 percent in January from 29 percent in December and 26 percent in January 2010.

“Increases in all-cash transactions, the investor market share and distressed home sales all go hand-in-hand. With tight credit standards, it’s not surprising to see so much activity where cash is king and investors are taking advantage of conditions to purchase undervalued homes,” Yun said.

All-cash purchases are at the highest level since NAR started measuring these purchases monthly in October 2008, when they accounted for 15 percent of the market. The average of all-cash deals was 20 percent in 2009, rising to 28 percent last year. Regionally, existing-home sales in the Northeast fell 4.6 percent, in the Midwest rose 1.8 percent, in the South existing-home sales increased 3.6 percent, and in the West rose 7.9 percent.

Confirming increased home buyers’ optimism was that pending home sales—reflecting recent contract signings—continued recent gains. Sales advanced 2.0 percent in December, following a 3.1 percent gain in November, and 10.1 percent surge in October. December's gain is the fifth in six months and reflects what the National Association of Realtors calls good affordability and economic improvement. It also reflects both increased consumer optimism and an improved jobs market.

Harlan Green © 2011