The Mortgage Corner

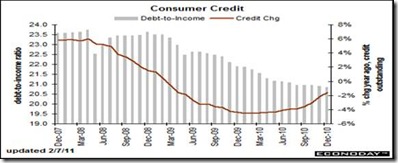

Big news. At long last, shopping looks like fun again. Consumers have pulled out their credit cards for the first time in many months, according to the Federal Reserve. And this will boost economic growth in 2011. Consumer credit rose $6.1 billion in December showing, for the first time in the recovery, gains for both revolving (credit card) and non-revolving credit (installment). Revolving credit, up $2.3 billion, rose for the first time in 27 months. Consumers are buying more cars even with higher gas prices, it seems. Non-revolving credit, reflecting strength in vehicle sales, extended its run of strength with a gain of $3.8 billion.

The quarterly uptick is a huge upward pivot, at an annual plus 2.6 percent in the fourth quarter vs negative 1.7 percent in the third quarter. The rise in revolving credit is important, reflecting the strength of the holiday shopping season and the new confidence among consumers to finance their purchases once again with their cards. And note a continuing drop in the household debt-to-income ratio, which means incomes are rising at the same time.

Motor vehicle sales in particular are approaching pre-recession levels. Vehicles sales have been on a steady uptrend since the 2009 drop off after the end of “cash for clunkers.” Sales of domestic light motor vehicles in January sold at a healthy 9.6 million rate, up 2 percent from prior month. Combined domestics and imports rose fractionally in January to a 12.6 million. For the month, sales were strongest for the cars component of domestic units, up 2.9 percent, while the weakest was for import cars, down 6.2 percent.

Holiday sales over the last two months have been quite good, says the Commerce Dept. But there are several stories in the details, according to Econoday. Overall retail sales in December rose 0.6 percent after jumping 0.8 percent the month before.

A key source of strength in recent months has been the autos which advanced 1.1 percent in December, following gains of 0.2 percent in November and 5.4 percent in October. For the latest month, excluding autos, sales were not quite as strong, rising 0.5 percent, following a 1.0 percent surge in November. Analysts had called for a 0.7 percent gain. With moderate pent up demand, this category likely will keep retail sales on an uptrend in coming months.

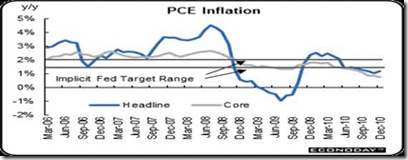

Another reason consumers are willing to shop are that prices are still being discounted. The Personal Consumption Expenditure (PCE) Index most favored by the Federal Reserve still shows very little inflation, as we say in our Financial FAQs column.

Though so-called headline inflation has been rising of late—mostly due to higher commodity prices elsewhere in the developing world—the core rate without food and energy prices continues downward.

Harlan Green © 2011

No comments:

Post a Comment