Popular Economics Weekly

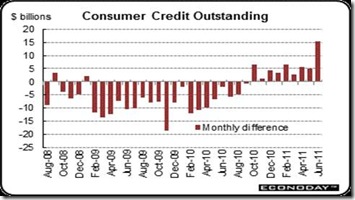

I actually agreed with Fed Chairman Bernanke in his latest Jackson Hole speech, when he said the Fed can’t grow the economy without some help. The weak growth of late has panicked markets, and Fed policy doesn’t seem to do the trick. Its record low interest rates aren’t helping at the moment, though that is keeping the housing market from dying completely.

So who is setting our monetary and fiscal policy these days? No one, at the moment. The White House is always one step behind events—worrying about deficit reduction when it can’t shrink the deficit without more job growth. And Congress is obsessing about the size of government, when government employment and spending have been shrinking faster than in the private sector.

“The country would be well served by a better process for making fiscal decisions,” was Bernanke’s understatement of the year, signaling it was fiscal policy that should now take the lead in growing the economy. So is Bernanke is throwing up his hands at the moment, in refusing to even hint at what other stimulus policies might come from the Fed until after a special 2-day September convocation of the FOMC? He was putting the policy ball back in the politicians’ court. It’s up to them to settle their differences if they want growth.

It’s of course obvious our ‘lack of a policy’ is now being set by the right wing of the Republican Party, who oppose all forms of stimulus. The downsizing of government has been their agenda since Ronald Reagan, and their only way seems to be by creating recessions. In fact, there have been 5 recessions during the last 3 Republican administrations. Two occurred during Reagan’s presidency (1980, 1981-82), one during Bush I (1991) and two during GW Bush’s presidency (2001, 2007).

Bernanke has been a strong advocate for an active Fed in stimulating economic growth in the past, which is why Nobelist Paul Krugman in effect called him craven for caving in to the Republican extreme right wing. “Now just imagine the reaction if the Fed were to act on the…arguably more important parts of the Bernanke 2000 agenda—more purchases of long term debt (i.e., a QE3), an announcement that short term rates would stay low for an extended period, to further reduce long term rates; and an announcement that the bank was seeking moderate inflation, “setting a target in the 3-4 percent range for inflation, to be maintained for a number of years.”

Bernanke himself actually accused the Bank of Japan at that time of a “self-induced paralysis” in not providing more stimulus to their sputtering economy, according to Krugman. “Well now, the Fed is suffering from externally induced paralysis,” he concludes.

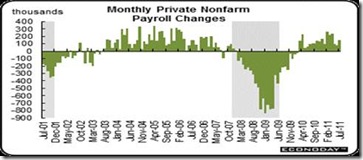

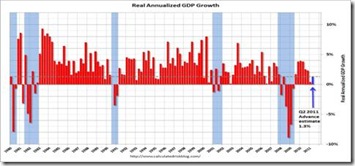

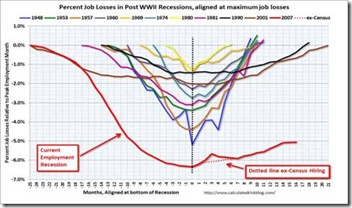

At a time when growth has slowed drastically through the first 2 quarters of 2011 after soaring above 4 percent for several quarters last year, the fears of a double-dip recession is depressing financial markets at the moment. But the outcome is more likely a “growth recession”, defined as slow growth amid rising unemployment that the Japanese have been experiencing for the last 20 years.

Bernanke’s scholarly treatise on the causes of the Great Recession comes at the same time that GDP Q2 growth had just been revised downward to 1 percent from 1.3 percent. “Unfortunately, the recession, besides being extraordinarily severe as well as global in scope, was also unusual in being associated with both a very deep slump in the housing market and a historic financial crisis,” said Bernanke.

Well, duh. How is that new news? He actually pins most of the blame for the current slowdown on the euro debt crisis and S&P downgrade. “It is difficult to judge by how much these developments have affected economic activity thus far, but there seems little doubt that they have hurt household and business confidence and that they pose ongoing risks to growth.” But then he goes on to discuss the need to cure the long term deficit, and only at the end of his speech does he mention the necessity for more job creation to cure the short term deficit due to the Great Recession.

“In the short term, Bernanke said, “putting people back to work reduces the hardships inflicted by difficult economic times and helps ensure that our economy is producing at its full potential rather than leaving productive resources fallow. In the longer term, minimizing the duration of unemployment supports a healthy economy by avoiding some of the erosion of skills and loss of attachment to the labor force that is often associated with long-term unemployment.”

Why so much emphasis on debt, rather than recovery? It is because of timidity on all sides, from the White House and Congress. Even Europe is suffering from the same paralysis in not providing enough aid to Greece, a paralysis that is now spreading through several other countries, says Krugman

“The fiscalization of the crisis story — the insistence, in the teeth of the evidence, that it was about excessive public borrowing — has become an article of faith on both sides of the Atlantic. And that faith has done and will do untold damage.”

So in effect the current slowdown is due to a paralysis of will from our leaders, not lack of monetary and fiscal tools to bring about a sustained recovery.

Harlan Green © 2011

![clip_image002[6] clip_image002[6]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhqOTetCbfaPJ5KtwmWY5Dt644hfEQDyAgOI1tLOyWIh3URMGocyYjqjZvGNHRQZdWrQRjVTEKjQ6M3QtlYj5qqiG8VQ_54zENyEax8B8MAXc6uzv_I4TLph_XZ-cJYznQs-L6JLY6LnQ/?imgmax=800)