Financial FAQs

What will increase the demand for more goods and services, the key to growing our economy? It’s been slowing since the 1970s, so is the question du jour, now that politicos are beginning to worry about the consequences of their budget-cutting frenzy. Everyone has their own answer, of course, that reflects their particular agenda—whether it’s shrinking government (lower taxes create more jobs), or using government to stimulate spending (when private sector won’t).

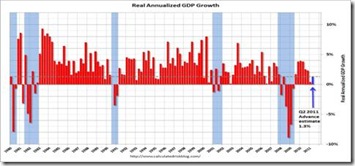

The answer is absurdedly simple and just needs some historical research to understand, rather than an economics degree. The problem has been a gradual reduction in the rate of economic (GDP) growth since the 1970s that was caused by many factors, but has resulted in a reduction in the overall demand for domestic goods and services—or aggregate demand in economic terms.

The long term slowdown was accompanied by increasing wealth disparities, as well as deregulation of whole business sectors—from media to transportation to finance. In fact, financial deregulation was the root cause of the housing bubble and Great Recession. It was also a time of tax cuts for the wealthiest when the maximum income tax bracket was reduced from its high of 92 percent in the 1950s to the current 35 percent, as well as increasing budget deficits.

This also hints at how to increase said aggregate demand, which is a combination of consumer and government spending, net exports, and investments to maintain or expand businesses. But it won’t be easy. Because it involves extensive restructuring of our tax code that has increased deficits and reduced incomes for most Americans since the 1970s, as well as strengthening financial regulations that would prevent another credit bubble--not downgrading government services, in a word. Only then will we be able to pay down our debt as well as grow much of the wealth lost during the Great Recession.

Today we are seeing the results of slower growth—increasing wealth disparities, higher disease rates than other developed countries, fewer educational opportunities (too expensive), a higher crime rate, and highest per capita prison population of all developed countries. We are imprisoning the dispossessed, in other words, rather than offering them the means to succeed.

Unfortunately, the gradual decline in economic growth has been largely below the radar of many economists, as well as the general public. Economists attribute much of it to aging factors, and the maxing out of credit use by consumers that has reduced consumption. Card use had surged through the 1960s when credit cards were introduced. But doesn’t the fact that above 65 households now earn more after inflation than those below 65 tell us something else?

If seniors are doing better—thanks in large part to Medicare and Social Security—then our aging population isn’t a main cause of declining demand. And if consumers have reduced their borrowing—that make up some 70 percent of economic activity—then it must be because of the fact their real, after tax incomes have not grown since the 1970s.

Aggregate demand, or AG, is a measure of what people or governments are willing to buy/sell, or invest. It must roughly equal the supply side of the supply-demand equation over time—U.S. Gross Domestic Product, the sum of all goods and services produced domestically.

This is why it is important to understand the concept of aggregate demand. An aggregate demand curve is the sum of individual demand curves for different sectors of the economy, says Wikipedia, the most available definition source. It’s not complicated. Aggregate demand is usually described as the sum of four separable demand sources.

where

is consumption (may also be known as consumer spending) = ac + bc(Y − T),

is Investment,

is Government spending,

is Net export,

- C is personal consumption expenditures or "consumption," demand by households and unattached individuals for goods and services; its determination is described by the consumption function. The consumption function is C= a + (mpc)(Y-T)

- a is autonomous consumption, mpc is the marginal propensity to consume, (Y-T) is the disposable income.

- I is gross private domestic investment, such as spending by business firms on factory construction. This includes all private sector spending aimed at the production of some future consumable.

- G is gross government investment and consumption expenditures

Consumers make up some 70 percent of economic activity, hence the importance of personal consumption expenditures (PCE). Businesses say they won’t expand or hire more workers unless they see greater demand for their products, which is understandable. It is only ideologues, or those with a political agenda who say not so. If we give more tax breaks to the producers and investors, they will automatically create more jobs. More profits = more jobs, in their words.

Alas, that has never happened in history, as Warren Buffett said most recently. The administrations of Ronald Reagan and GW Bush gave the largest tax breaks to business and investors in the belief it created more jobs. But the result was 3 recessions, not greater demand (actually 4, including Bush I’s term), and also the largest increase in deficits of those times.

It should be blindingly obvious that the resultant massive concentration of wealth at the top has reduced overall aggregate demand for the rest of ‘U.S’. Most aggregate demand is generated by the incomes of the wage and salary earners, but also some of the smaller self-employed businesses, whose incomes have barely kept up with inflation since the 1970s.

And as the formula shows, demand is stimulated by government as well as private sector spending and investment. Right now, the private sector is hoarding their cash, as we have said, so it must be up to the government to dig us out of the debt hole—by job creation programs that put more monies in consumers’ pockets, not tax breaks for the wealthiest. Only then will we increase incomes of the 80 percent who have suffered most from the restructuring of our economy that has happened since the 1970s.

Harlan Green © 2011

No comments:

Post a Comment