Popular Economics Weekly

How do we know what to look for in 2012? We should not be looking at the headlines, which tend to trumpet totally conflicting news. But more accurate information is available—usually several months later.

For instance, jobs’ formation was much better than initially reported from August onward by the Bureau of Labor Statistics. And some of the regional activity indicators like that of the Philadelphia Federal Reserve that panicked markets have since been revised upward.

The problem? In an attempt to make seasonal adjustments—i.e., tweak the numbers so that they reflect any changes above or below what is normal for that season—the data sometimes subtracts too much from the seasonal variations, making the initial numbers look much worse than they are. The result is, “If the market had known then what it knows now, the drop in the markets in August would have been much milder”. Said a recent Marketwatch article.

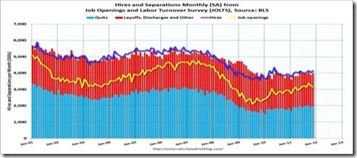

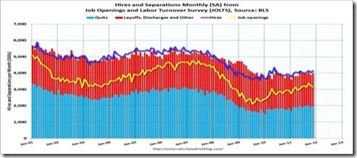

So savvy investors should not be reacting to the initial headlines. For instance, the most accurate unemployment picture is given by the Bureau of Labor Statistics JOLTS report, which lags the unemployment report by 2 months. It is a survey of actual job openings/layoffs. It’s latest report is for November, which showed 3.2 million openings, unchanged from October. Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the level in November was 1.0 million higher than in July 2009 (the most recent trough for the series). The number of job openings has increased 30 percent since the end of the recession in June 2009.

The Institute for Supply Management (ISM) manufacturing and non-manufacturing (service sector) indexes are the best measure of overall economic activity, and both continue to increase.

And as I said in a recent Mortgage Corner column, construction activity is picking up, which is the part of real estate that influences actual economic growth, since it powers insurance, mortgage, and real estate sales, among other businesses. Only public construction spending hasn’t picked up in 2011, but all other areas of commercial and residential construction have.

Harlan Green © 2012

How do we know what to look for in 2012? We should not be looking at the headlines, which tend to trumpet totally conflicting news. But more accurate information is available—usually several months later.

For instance, jobs’ formation was much better than initially reported from August onward by the Bureau of Labor Statistics. And some of the regional activity indicators like that of the Philadelphia Federal Reserve that panicked markets have since been revised upward.

The problem? In an attempt to make seasonal adjustments—i.e., tweak the numbers so that they reflect any changes above or below what is normal for that season—the data sometimes subtracts too much from the seasonal variations, making the initial numbers look much worse than they are. The result is, “If the market had known then what it knows now, the drop in the markets in August would have been much milder”. Said a recent Marketwatch article.

So savvy investors should not be reacting to the initial headlines. For instance, the most accurate unemployment picture is given by the Bureau of Labor Statistics JOLTS report, which lags the unemployment report by 2 months. It is a survey of actual job openings/layoffs. It’s latest report is for November, which showed 3.2 million openings, unchanged from October. Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the level in November was 1.0 million higher than in July 2009 (the most recent trough for the series). The number of job openings has increased 30 percent since the end of the recession in June 2009.

Graph: Calculated Risk

Jobs openings declined slightly in November, but the number of job openings (yellow) has generally been trending up, and are up about 7 percent year-over-year compared to November 2010. Quits increased in November, and have mostly been trending up - and quits are now up about 12 percent year-over-year. These are voluntary separations and more quits might indicate some improvement in the labor market. (see light blue columns at bottom of graph for trend for "quits").

Graph: Econoday

The monthly employment report shows significant broad-based improvement. And the unemployment rate dipped to 8.5 percent, as we know. Payroll jobs in December jumped a relatively healthy 200,000 after rising a revised 100,000 in November and increased a revised 112,000 in October. Private payrolls again outstripped the total, gaining 212,000 in December, following increases of 120,000 in November and 134,000 in October. The Institute for Supply Management (ISM) manufacturing and non-manufacturing (service sector) indexes are the best measure of overall economic activity, and both continue to increase.

Graph: Econoday

The latest gain in the Manufacturing Composite was led by increases in the production and employment indexes. Production jumped to 59.9 from 56.6 in November. Employment rose to 55.1 from 51.8. The boost in employment is likely a vote of confidence by manufacturing management for stronger demand in coming months.

Graph: Econoday

The ISM non-manufacturing Composite Index is not so robust, but still holding above 50 percent, with its overall activity index at 56.2 percent, still a very good number.And as I said in a recent Mortgage Corner column, construction activity is picking up, which is the part of real estate that influences actual economic growth, since it powers insurance, mortgage, and real estate sales, among other businesses. Only public construction spending hasn’t picked up in 2011, but all other areas of commercial and residential construction have.

Graph: Econoday

So this data tells us there is still a lot of fear to overcome, with many pundits and forecasters expecting the worst—the worst being more of what happened last year—whether it is supply disruptions, Tsunamis, the Middle East, or a euro crisis. We need another year of solid growth, in other words, before the economy becomes strong enough to endure such ‘shocks’.Harlan Green © 2012

1 comment:

You can best subscribe to my blogs on Twitter....@HarlanGreen

Post a Comment