The Mortgage Corner

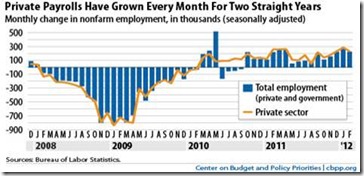

Housing prices needs one more year to begin to recover, according to several pundits and economists, including Barron’s Magazine and Professor Karl Case, co-creator of the S&P Case-Shiller Home Price Index. And that mostly depends on two factors—increased household formation and record housing affordability. Employment shouldn’t impede the recovery, as the unemployment rate will continue to drop, while the Fed is committed to keep interest rates low through 2014.

JPMorgan Chase CEO Jamie Dimon also said the U.S. housing market is very close to a bottom and there are already signs its improvement is giving a boost to the overall economy, in a CNBC interview. “"I believe we’re very close to the inflection point. People look at prices that are still coming down but all the other signs are flashing green," Dimon said during a job fair in New York for hiring veterans. Housing is more affordable and "the shadow inventory everyone talks about is lower today than it was 12 months ago. It will be a lot lower 12 months from now," he said.

This is mainly because housing affordability conditions have reached the highest level since recordkeeping began in 1970, according to the National Association of Realtors. NAR’s Housing Affordability Index rose to a record high 206.1 in January, based on the relationship between median home price, median family income and average mortgage interest rate. The higher the index, the greater the household purchasing power.

Affordability rose so high in January because the median existing home price fell to it lowest level since the recession--$154,400—while the 30-year fixed mortgage rate held at 4.37 percent. This meant that the monthly payment as a percentage of median income fell to just 12.1 percent.

NAR President Moe Veissi said this latest data underscores buyer opportunities in today’s market. “This is the first time the housing affordability index has broken the two hundred mark, meaning the typical family has roughly double the income needed to purchase a median-priced home,” he said. “For buyers who can qualify for a mortgage, now is a very good time to become a homeowner.”

And household formation is projected to grow from approximately 600,000 in 2011 to the more historical average of 1 million households per year in coming years, says the U.S. Census Bureau. This should soak up excess existing and new-home inventories that have already dropped to 6 months’ levels.

“According to one recent estimate, the number of excess vacant housing units in the existing housing stock can be attributed to a steep decline in demand during the Great Recession,” says the Census Bureau report. “Household formations (e.g., adult children leaving parents’ households, singles leaving shared housing arrangements, etc.) are the largest component of demand for additions to the housing stock. These new households are accommodated by additions to the housing stock when vacancy rates are low, and are absorbed into the existing vacant stock when vacancy rates are high. Since 1965, the number of households in the US has grown at an average annual rate of 1.5 percent, adding an average of roughly 1.3 million new households per year, according to the Census Bureau’s Housing Vacancy Survey.”

Graph: U.S. Census Bureau

And the Pending Home Sales Index, a forward-looking indicator based on contract signings, eased 0.5 percent to 96.5 in February from 97.0 in January but is 9.2 percent above February 2011 when it was 88.4. The data reflects contracts but not closings.

NAR chief economist Lawrence Yun said we’re seeing the continuation of an uneven but higher sales pattern. “The spring home buying season looks bright because of an elevated level of contract offers so far this year,” he said. “If activity is sustained near present levels, existing-home sales will see their best performance in five years. Based on all of the factors in the current market, that’s what we’re expecting with sales rising 7 to 10 percent in 2012.”

Harlan Green © 2012