Popular Economics Weekly

Economic growth is finally accelerating. Consumer demand plus manufacturing are continuing to increase, and even the fourth quarter was a little stronger as Q4 GDP growth broke the psychological 3 percent boundary. The Commerce Department revised fourth quarter GDP growth up to 3.0 percent from the initial estimate of 2.8 percent. The latest figure compares to a modest 1.8 percent rise in the third quarter.

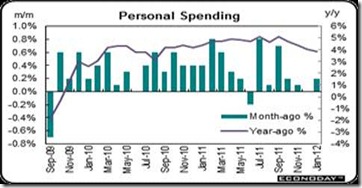

Graph: Econoday

The major reason was increased consumer spending. Consumer spending in January improved to a 0.2 percent gain from no change in December. The goods components were stronger as durables gained 0.9 percent after a 0.5 percent increase in December.

Graph: Econoday

This mainly due to the increase in household debt, as banks are easing their credit for consumers. For the first time since the Great Recession, household debt saw a quarterly gain, according to Federal Reserve data released Thursday that shows American deleveraging has at the very least paused. Household debt edged up 0.3 percent in the fourth quarter, the Fed reported in its flow-of-funds report, as consumer credit surged an annualized 7 percent. Household debt had declined for 13 consecutive periods before the slender fourth-quarter advance.

Spending has been increasing from 4 to 5 percent per year for the past 2 years, mainly from automobile sales. Total unit sales jumped 6.5 percent in the month to an annual rate of 15.1 million. The gain was centered in cars, especially imports. But this aside, gains in February data were strong and do include trucks. January sales actually squeaked higher than the cash-for-clunkers surge in August 2009 and February notably topped that month’s 14.2 million unit sales pace, said Econoday.

Graph: Econoday

And as a prelude to Friday’s unemployment report, Automatic Data Processing, or ADP, a payroll servicing company, estimates that February private payrolls in Friday's employment report will rise by 216,000, up solidly from January's revised rise of 173,000.

Graph: Econoday

Even better news was that service sector activity, which is some 80 percent of U.S. business, continues to expand. Rising orders headline a very positive non-manufacturing report from the ISM where the headline composite index is up five tenths to a better-than-expected level of 57.3. But the composite may understate underlying strength in the bulk of the nation's economy where order levels are building with new orders up nearly two points to a very strong 61.2 vs January's already very strong 59.4. Strength in new orders is feeding a build in backlog orders which rose 3.5 points to 53.0 which is a strong level for this reading.

Graph: Econoday

All-in-all we are seeing a very good start for 2012, which is also a presidential election year, don’t forget. And that means the Obama Administration (and Federal Reserve) will be doing all government can do to boost growth.

Harlan Green © 2012

No comments:

Post a Comment