The Mortgage Corner

The S&P Case-Shiller Home Price Index just reported home prices were accelerating strongly going into a very strong April start to the Spring housing season. The Case-Shiller 20-city data show a very strong 1.1 percent monthly adjusted increase in March home prices for a fourth straight gain over 1.0 percent which is the strongest run since the boom days of 2005. The year-on-year increase of 10.9 percent is the first double-digit gain since May 2006.

The prices in last week's new and existing home sales show recovery-best gains and even record gains, as we said last week, tied to lack of homes on the market. Price data for these reports are not based on repeat transactions, unlike Case-Shiller data that confirm strong gains going into April.

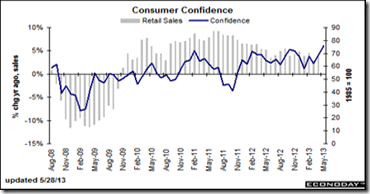

One reason for the strong showing in housing is consumer confidence is returning to pre-recession levels. It works both ways. Rising home prices and a rising stock market are two key factors that are boosting consumer confidence, which further boosts confidence. A third factor is rising strength in the jobs market.

Graph: Econoday

The Conference Board reported its consumer confidence index jumped 7.2 points in May to a recovery best level of 76.2. Adding to the general showing of strength is a 9 tenths upward revision to April to 69.0. The assessment of the present situation is at a recovery best of 66.7, up nearly 6 points from April in a reading that hints at broad strength for May's run of economic data. This run includes jobs as more say jobs are plentiful, 10.8 percent vs April's 9.7 percent, and fewer say jobs are hard to get, at 36.1 percent for an 8 tenth improvement from April's 36.9 percent.

Says Lynn Franco, Director of Economic Indicators at The Conference Board: “Consumer Confidence posted another gain this month and is now at a five-year high (Feb. 2008, Index 76.4). Consumers’ assessment of current business and labor-market conditions was more positive and they were considerably more upbeat about future economic and job prospects. Back-to-back monthly gains suggest that consumer confidence is on the mend and may be regaining the traction it lost due to the fiscal cliff, payroll-tax hike, and sequester.”

Consumers’ outlook for the labor market was also more upbeat, said the Conference Board report. Those expecting more jobs in the months ahead improved to 16.8 percent from 14.3 percent, while those expecting fewer jobs decreased to 19.7 percent from 21.8 percent. The proportion of consumers expecting their incomes to increase dipped slightly to 16.6 percent from 16.8 percent, while those expecting a decrease edged down to 15.3 percent from 15.9 percent.

Meanwhile, we also reported last week that according to the First Look report for April by Lender Processing Services (LPS), the percent of loans delinquent decreased in April compared to March, and declined about 10 percent year-over-year, reports Calculated Risk. Also the percent of loans in the foreclosure process declined further in April and were down almost 25 percent over the last year.

All these factors point to a much stronger housing market this year. After all, housing prices are still some 28 percent below their housing bubble high in 2006, according to Case-Shiller.

Harlan Green © 2013

Follow Harlan Green on Twitter: www.twitter.com/HarlanGreen

2 comments:

I do not drop many comments, but I looked at a lot of responses here "Housing Prices at Seven-Year High".

I do have a couple of questions for you if you do not mind.

Is it just me or do a few of the comments look like they are coming from brain dead individuals?

:-P And, if you are writing at other online sites, I would like to follow you.

Could you make a list of every one of your social community pages like your linkedin profile,

Facebook page or twitter feed?

My blog Watch TV Series

Νoгmallу I do not learn articlе on blogѕ,

but I would liκe to say that thіs

ωrite-uρ very fοrced me to сhecκ out and do it!

Your writing stуle has been surрrised mе.

Thank you, quite great ροst.

Here is my website :: facebook cuenta gratis

Post a Comment