The Mortgage Corner

Calculated Risk and Housing Tracker report that existing-home for sale inventories have increased 4.7 percent in February. It is good news for those who worry that the lack of inventory will hold back existing-home sales this year.

The red line denotes 2014 inventory from Housing Tracker’s Department of Numbers. California cities led the increases, with San Francisco inventory up 7.1 percent, San Jose + 8.6 percent, and Sacramento + 8.8 percent. And as of February 10, San Francisco had the highest weekly price increase of 4.9 percent. Thank you, Silicon Valley, as such high-tech startups as Twitter are headquartered in San Francisco.

This should mean price increases will slow, however, as more supply comes on the market, and default ratios continue to decline. The median asking price for homes in the US peaked in June 2006 at $319,459 and is now 21.1 percent lower. From a low of $211,844 in January 2011, the median asking price in the US has increased by $40,327 (19.0 percent), says Housing Tracker.

Tracking total distressed sales is the best way to determine how quickly housing is recovering from the Great Recession. And California’s distressed sales have dropped sharply in a year, down to 22.2 percent of sales in December 2013, vs. 42.5 percent in December 2013, according to Calculated Risk. Sacramento, noted for overbuilding even in good years, had the sharpest drop with total distressed sales down to 22.2 percent of sales in Dec. 2013, vs. 51.5 percent in December 2012.

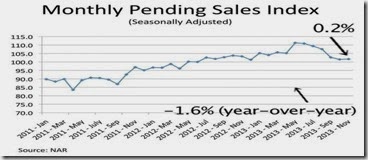

However, the NAR’s Pending Home Sales Index, a forward-looking indicator based on contract signings, fell 8.7 percent to 92.4 in December from a downwardly revised 101.2 in November, and is 8.8 percent below December 2012, as we said last week. The data reflect contracts but not closings, and are at the lowest level since October 2011, when the index was 92.2.

But we believe with the percentage of conventional (vs. distressed) sales’ inventories increasing, existing-home sales will pick up in 2014. And if not, then new-home sales will take up the supply slack, with new-home building permits issued increasing close to 1 million annually.

Sales of newly built, single-family homes fell 7 percent to a seasonally adjusted annual rate of 414,000 units in December, according to newly released figures from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. Despite the monthly drop, home sales in 2013 were up 16.4 percent over the previous year. But several factors seem to be slowing down new-home sales.

Harlan Green © 2014

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment