Popular Economics Weekly

One lament by Fed Chairperson Janet Yellen and others has been the low labor participation rate of the prime-age workers—those 25 to 54 year-olds that have dropped out of the labor force, or are working part time. But that may be changing, as we get closer to full employment.

The Atlanta Fed has just published an optimistic study that says they might be coming back to work. Atlanta Fed President Dennis Lockhart commented on it in a recent speech:

“Over the last few years, there has been a worrisome outflow of prime-age workers—especially men—from the labor force. I believe some of these people will be enticed back into formal work arrangements if the economy improves further.”

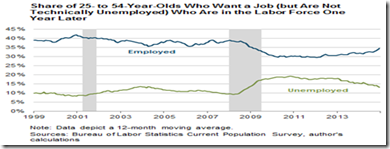

The decline in the "shadow labor force"—the share of the prime-age population who say they want a job but haven’t been looking (i.e., are not technically counted as unemployed)—demonstrates the cyclical nature of the labor market, says Lockhart. For the last year and half, the share of these individuals in the labor force had been generally declining (see the chart).

But now the ability of the prime-age shadow labor force to find work is improving at the same time that the Labor Force Participation rate of the prime-age population is stabilizing. Taken together, this trend is consistent with improving job market opportunities and further absorption of the nation's slack labor resources, says the Atlanta Fed.

What might be enticing them back into the labor force? Rising wages and salaries, of course. About 70 percent of U.S. companies indicate that wages are starting to outpace inflation, according to a recent Duke University study of 500 CFOs. Wage growth should be at least 3 percent in tech, services and consulting, manufacturing and health care.

"The U.S. is finally entering a new phase in the economic recovery," said John Graham, a finance professor at Duke's Fuqua School of Business and director of the survey. "The first few years of recovery were 'jobless' and, even as job growth picked up over the past year, wages remained stagnant. Finally, we are starting to see wage growth for employees that outstrips inflation. Given that CFOs expect continued strong employment growth, it is surprising that wage pressures are not even greater."

But wage growth will remain subdued at about one-third of companies that indicated employee pay will not outpace inflation in the survey. In particular, employees in retail/wholesale, transportation/energy and communications/media should expect pay hikes of less than 2 percent. The primary reasons are weak company financial performance, intense product market competition that keeps a lid on wages (because of need to keep production costs lean?), and minimal labor market pressure in these industries.

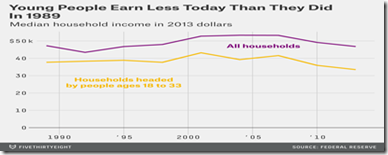

And we said last week that analyzing about three decades of census data—from 1980 to 2012—the Federal Reserve’s 2013 Survey of Consumer Finances found that on average, young workers are now 30 years old when they first earn a median-wage income of about $42,000, a marker of financial independence, up from 26 years old in 1980.

But with increasing employment and wage pressures, the financial well-being of younger workers should improve. It isn’t just the millennial generation of 18 to 36 year-olds that has suffered from the Great Recession, in other words.

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment