Financial FAQs

As if further confirmation was needed that Fannie Mae and Freddie Mac were not even a minor cause of the housing bubble and consequent bust, the latest judgment against Nomura Securities for selling fraudulent mortgages to Fannie and Freddie should be icing on the cake; settlements that now total more than $14 billion in fines for almost all the major banks and lending institutions.

The charge is old. Critics, (mainly those caught selling fraudulent loans to Fannie and Freddie) have long maintained that the GSE’s encouraged too many people to buy homes by offering all manner of payment assistance, and even guaranteeing subprime mortgages from the likes of Countrywide Financial (that was subsequently bought by Bank of America).

A U.S. judge on Monday ruled that two more large financial entities, including Nomura Holdings Inc., made false statements in selling mortgage-backed securities to Fannie Mae and Freddie Mac ahead of the 2008 financial crisis.

U.S. District Judge Denise Cote in Manhattan ruled for the Federal Housing Finance Agency, the conservator for Fannie Mae and Freddie Mac, in a ruling that could allow the U.S. regulator to recover around $450 million.

This is one more example of how almost all of the major financial institutions jumped on the bandwagon that encouraged the housing bubble—lending money to both qualified and unqualified borrowers and then misrepresenting their quality to the main guarantors of US housing finance.

Cote, who presided over a non-jury trial, said the FHFA was entitled to judgment against Nomura and the Royal Bank of Scotland Plc, which underwrote some of the $2 billion in mortgage-backed securities, in light of misstatements they made in offering documents.

Such originators were the real problem. Nomura Securities is just one of a growing list of mortgage lenders that have had to settle fraud charges that the loans submitted to Fannie and Freddie weren’t the quality loans they had certified—16 at last count totaling more than $14 billion in fines, as we said. Their loans had not in fact conformed or even followed Fannie and Freddie’s qualification standards, including verification of income and even whether they held real jobs, when they sought their guarantee insurance.

The result was the demonization of the GSEs as undercapitalized and incapable of fulfilling their mandate to make housing more affordable to Main Street Americans. I have been writing about the resistance of US Treasury—and maybe White House—to any recapitalization of Fannie and Freddie’s corporations to cushion them from another such housing downturn, corporations that were set up in the 1930s and 40s respectively to encourage home owning.

And in successfully fulfilling their mandate, they were a major factor in creating middle class Americans’ wealth, much of which was destroyed during the Great Recession. FDR’s Home Loan Corporation came to the rescue during the Great Depression, and we should be doing the same for housing in order to aid our recovery from the Great Recession.

Then why does Treasury, and even the White House oppose recapitalizing them, in spite of their now record-breaking profits? Because Treasury seems to believe there is a better alternative. However, that is yet to be seen and the GSEs are guaranteeing more than 60 percent of originations these days, while making the Treasury literally $$billions.

The Federal Housing and Finance Authority has just issued an update on their plans to ‘reform’ the GSEs. It is a proposal to form a Common Securitizing Platform (CSP) to replace competing Fannie Mae and Freddie Mac platforms that securitize its mortgage pools.

“The objectives in developing a Single Security are to establish a single, liquid market for the mortgage-backed securities issued by both Enterprises that are backed by fixed-rate loans and to maintain the liquidity of this market over time,” says the FHFA. “Achievement of those objectives would enhance the liquidity of the TBA market and further FHFA’s statutory obligation to ensure the liquidity of the nation’s housing finance markets.”

The question then is what comes next? The Treasury says their overall objective of not recapitalizing Fannie and Freddie is to induce private originators to guarantee a larger majority of mortgages. So will Banks and other private loan originators then step up to the plate and issue pools that can be either purchased or guaranteed by the CSP, which up to now they have been reluctant to do, without the GSEs’ guarantee?

And if the Treasury dissolves the GSEs, as it says it ultimately intends in order to put, “private capital at risk ahead of taxpayers,” can private issuers of said mortgage-backed-securities be the guarantors, without substantially raising their fees and profit margins, which will raise interest rates, as well? There was a reason Fannie and Freddie conforming mortgage rates were so affordable. They had lower capitalization requirements, in part because of the superior quality of their mortgage underwriting standards, and consequent low delinquency rates.

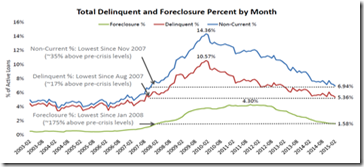

Then who will enforce the very successful underwriting standards now required by Fannie and Freddie that has brought down the default rates close to historical standards? It is the real issue that was exposed in the lawsuits. Who will police the banks and private mortgage originators that the record shows will evade those standards when it suits them?

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment