Financial FAQs

Although economists haven’t yet begun to crunch the numbers, Iran’s agreement not to produce atomic weapons or weapon-grade plutonium for at least 10 years will result in much lower oil prices, thus keeping inflation in check and interest rates at their current lows for some time to come, if not years.

This is if Congress approves the deal, of course. But lifting the economic sanctions will enable Iran to begin to sell its oil internationally sometime next year, into a world already flooded with oil products, though there is some uncertainty when this will happen.

Barron's, for instance, believes it will happen slowly, which might not affect oil prices in the short term, at least. When and if sanctions are lifted, Iran's oil production has to be ramped up, facilities upgraded, so that its products will only gradually reach international markets.

This is when retail inflation via the Consumer Price Index is already zero—i.e., retail prices aren’t rising at all. So it will give Janet Yellen’s Federal Reserve room to keep interest rates lower longer, thus boosting consumer spending and housing, which is beginning to show more robust growth with builder confidence at its highest level since 2005.

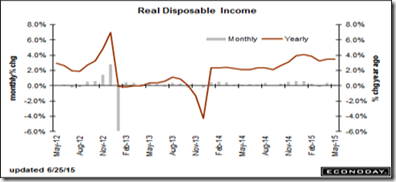

It will also boost consumer incomes, which are already profiting from the low interest rate environment that has reduced borrowing costs for consumers. Real (after inflation) consumer incomes are now rising at 4 percent.

Wages & salaries rose 0.5 percent in the month. Both proprietors' income and rental income show especially strong gains. Spending was higher for durables, especially to autos, and also strong gains for non-durables, partly because of higher gas prices.

This in turn is boosting consumer spirits, with both the Conference Board and U. of Michigan surveys now at pre-recession levels.

Optimism in the closely watched consumer sentiment report from the University of Michigan is as strong as it can get, according to Econoday. The overall index is up sharply this month and well beyond Econoday's high-end forecast. The report's expectations component, reflecting strong optimism for the jobs market, is an absolute standout at 97.8 for a 12-year high and a 13.6 point surge from May. The 13.6 point spread is the largest monthly gain since March 1991 (that's right, 1991).

There is a downside to the agreement, of course. Russia and China will benefit from doing more business with Iran, and Iran could backslide on the agreement. But there is general agreement that Iran's nuclear weapons ban will boost growth throughout developed countries with consumer-driven economies that require low inflation and cheap energy to maintain sustainable economic growth.

Harlan Green © 2015

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment