Financial FAQs

Central Banks everywhere seem to be following our Federal Reserve in selling bonds they had accumulated to keep interest rates low for so long—in fact, since the end of the Great Recession. They also seem to be crossing fingers that it won't hurt growth.

The 10-year Treasury yield rose 1.8 basis point to 2.285 percent, contributing to a 14 basis point jump over the past week. The 30-year bond, or the long bond, gained 1.7 basis point to 2.831 percent, according to Marketwatch.

Our Fed Chair Janet Yellen took the lead in calling for more Fed rate hikes this year at the last FOMC meeting; as well as beginning to sell some of the $4.5 billion in Treasury bonds it had accumulated during the various Quantitative Easing programs first initiated by former Fed Chair Ben Bernanke.

The QE programs and extremely low inflation have kept long term rates below 3 percent for several years. The Fed’s actions in tightening credit mean they see higher inflation and growth ahead. But so far it’s just words. They are hoping that talking up interest rates will have the effect of boosting growth, for some reason.

I don’t see how, since consumer spending and business investment are still at post-recession lows. First quarter GDP’s final growth estimate rose from 1.2 to 1.4 percent and it’s averaged 2 percent annually since 2009, the end of the Great Recession. That’s the reason for the various QE bond buying programs that have taken so many bonds out of the market.

So the question is, as the Fed begins to sell them back into the bond market will interest rates rise? They are taking a gamble, since consumers aren’t spending as they should, and inflation is falling, rather than rising—another sign of weak demand.

Graph: Econoday

Real disposable personal income has fallen precipitously since 2014, and the Fed’s preferred PCE inflation index is down to 1.4 percent annually. That should be a danger sign, rather than a sign of higher growth.

Maybe the Fed is looking at consumer optimism, still holding at November post-election highs. Both the University of Michigan sentiment survey and Conference Board’s confidence survey show extreme optimism about future prospects.

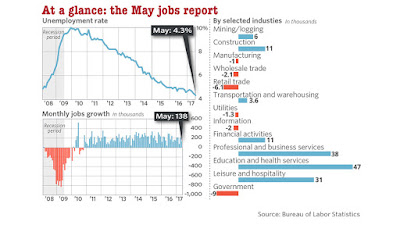

Why such optimism? We are nearing full employment, or perhaps there is the hope that Republicans may be able to pass an infrastructure bill that would boost state and federal work projects.

But then Congress has to begin work on legislation that both Republicans and Democrats can agree on. They shouldn’t wait on much more partisan legislation that isn’t likely to pass—like reforming health care and cutting taxes, which no one seems to be able to agree on.

Harlan Green © 2017

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen