Popular Economics Weekly

The Conference Board Leading Economic Index® (LEI)for the U.S. increased 0.2 percent in May to 109.5 (2016 = 100), following a 0.4 percent increase in April, and a 0.4 percent increase in March.

This monthly announcement of the LEI is a good predictor of future economic growth because it reports on 12 items that measure trends on everything from interest rates, to housing permits, to stock prices, and hours in the work week. It is slowing, surely not a coincidence with the talk of a worldwide trade war.

“While May’s increase in the U.S. LEI was slower than in recent months, the improvements in a majority of its components offset the declines in leading indicators of labor markets and residential construction,” said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board. “The U.S. LEI still points to solid growth but the current trend, which is moderating, indicates that economic activity is not likely to accelerate.”That’s because raising tariffs on imported goods and services is raising taxes, which Republicans aren’t supposed to do, and all reputable economists agree slows growth.

Here’s another reason why it not good to raise taxes on imported goods. Firstly, some 80 percent of what consumers buy is imported. And consumers overall incomes haven’t been rising at all in 2017 when inflation is subtracted from the total.

Marketwatch economist Rex Nutting reports that although GDP growth in Q2 could be as high as 4.5 percent, 2014 was a much better year when average nominal wages were rising 1.3 percent above the inflation rate. And that is really what determines consumers’ demand for goods and services.

With consumers already skating on thin ice with their finances; so much so that their personal savings rate has sunk to a decade low 2.3 percent; raising taxes could well bring us to a tipping point. Let’s not forget a recession starts when economic activity has peaked, and can go no higher, and starts an inevitable decline.

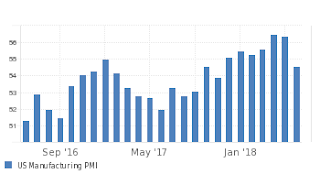

Another economic indicator just out is the IHS Markit US Manufacturing PMI, which fell to 54.6 in June from 56.4 in May, well below market expectations of 56.5. The reading pointed to the slowest expansion in factory activity in 7 months, preliminary estimates showed. New work rose the least since September, partly reflecting a slight drop in export sales.

Was the drop in exports because of the tariff wars? The Great

Recession began in December 2017 with the US still at full employment. Job

losses didn’t accelerate until it dawned on the public in mid-2008 that Wall

Street and the banks were in big trouble.

The unemployment rate fluctuated wildly, from a low of 4.7 percent in 2008 to a peak of 10.1 percent in 2009, after the U.S. housing bubble burst and Wall Street saw collapses unlike those seen since the Great Depression in the 1930s.

Future economic growth seems to be trending downward, so the effects of this trade war will loom sooner or later.

Harlan Green © 2018

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment