The Mortgage Corner

FRED

WASHINGTON (July 23, 2019) – Existing-home sales weakened in June, as total sales saw a small decline after a previous month of gains, said the National Association of Realtors®. While two of the four major U.S. regions recorded minor sales jumps, the other two – the South and the West – experienced greater declines last month.

The problem is still not enough affordable housing. The demand is there for mid-range housing, as 56 percent of homes sold in less than 30 days, and unsold inventory is at a 4.4-month supply at the current sales pace, up from the 4.3 month supply recorded in both May and in June 2018; when there is normally a 6-month supply if supply and demand are in balance.

Total existing-home sales, https://www.nar.realtor/existing-home-sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, dropped 1.7 percent from May to a seasonally adjusted annual rate of 5.27 million in June. Sales as a whole are down 2.2 percent from a year ago (5.39 million in June 2018).

“Home sales are running at a pace similar to 2015 levels – even with exceptionally low mortgage rates, a record number of jobs and a record high net worth in the country,” said Lawrence Yun, NAR’s chief economist. Yun says the nation is in the midst of a housing shortage and much more inventory is needed. “Imbalance persists for mid-to-lower priced homes with solid demand and insufficient supply, which is consequently pushing up home prices,” he said.Yun said other factors could be contributing to the low number of sales, as well.

“Either a strong pent-up demand will show in the upcoming months, or there is a lack of confidence that is keeping buyers from this major expenditure. It’s too soon to know how much of a pullback is related to the reduction in the homeowner tax incentive.”What are consumers doing with their high net worth? Many are remodeling, instead of moving. Existing-home owners are remaining in their homes much longer. The recent average is 10 years, when 4 years has been the historical average years of duration in the same residence.

There are slightly more first-time buyers this season with record-low interest rates. First-time buyers were responsible for 35 percent of sales in June, up from 32 percent the prior month and up from the 31 percent recorded in June 2018.

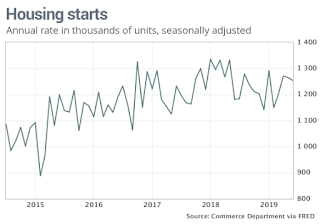

Construction of new houses also fell slightly in June and permits sank to the lowest level in two years, exacerbating the shortage and suggesting a sluggish U.S. housing market has failed to gain much momentum from lower mortgage rates.

FRED

Housing starts slipped 0.9 percent to an annual pace of 1.25 million last month, said the Commerce Department. That’s how many homes would be built in 2019 if construction took place at same rate over the entire year as it did in June.

Permits to build more homes, meanwhile, sank 6.1 percent to a 1.22 million pace, the government said Wednesday. That’s the lowest level since mid-2017.

And lastly, new-home sales also declined to a lower-than-expected 646,000 annual rate. The 3-month average is at 636,000 which compares unfavorably against a 673,000 peak in April.

This was still the highest sales for June since June 2007, and annual sales in 2019 should be the best year for new home sales since 2007, according to Calculated Risk, and suggests homebuyers haven’t let up on their enthusiasm to own a home, if they can afford one.

Harlan Green © 2019

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen

No comments:

Post a Comment